About Chargebacks (Core Funded Merchants)

This document describes chargebacks for Core Funded Merchants.

Overview

A chargeback happens when a customer disputes a transaction with their bank or credit card company, leading to a reversal of the payment.

In a traditional single-payment transaction, you may only face one chargeback for the total amount. With the Splitit installment solution, each installment is susceptible to individual chargebacks. Despite this difference, the chargeback process, including the submission of evidence, remains consistent for both transaction types.

Key Things to Know:

- Shoppers generally have 120 days to file a chargeback after a purchase is made

- The merchant owns the risk for chargebacks (except for a few anomalous cases)

- The best place to get information about your chargebacks is directly through your gateway platform

Common Reasons for Chargebacks

- Unauthorized Transactions: If a cardholder notices a transaction on their statement that they did not authorize, they may initiate a chargeback

- Non-Delivery of Goods or Services: If the cardholder paid for a product or service that was not delivered as promised, they might file a chargeback

- Dissatisfaction with a Product or Service: If a received item or service is significantly different from what was described by a merchant, the cardholder may dispute the charge

- Fraudulent Transactions: In cases of identity theft or credit card fraud, the legitimate cardholder may dispute charges made without their knowledge or consent

Splitit's Chargeback Policy

Splitit does not assume liability for amounts that are charged back. Merchants must register for chargeback webhooks in order to notify Splitit of any chargebacks and to facilitate an effective resolution.

When a dispute is filed, Splitit will immediately debit from your account, into a reserve, the outstanding plan balance. If all chargebacks are won and the shopper is successfully charged, you will be credited the full reserve amount. If a chargeback is lost, the shopper will keep the funds, and the refund amount will be collected and the reserve balance returned.

Splitit does not assume responsibility for collecting amounts owed to you in cases where you win a chargeback but Splitit is unable to capture the outstanding balance.

What to Do When You Receive a Chargeback Notice from Splitit

Review the Chargeback Notice

Understand the reason for the chargeback. Begin by either accepting the chargeback or disputing it. If you choose to dispute, proceed to the next step.

Locate and Review Your Chargeback Transactions

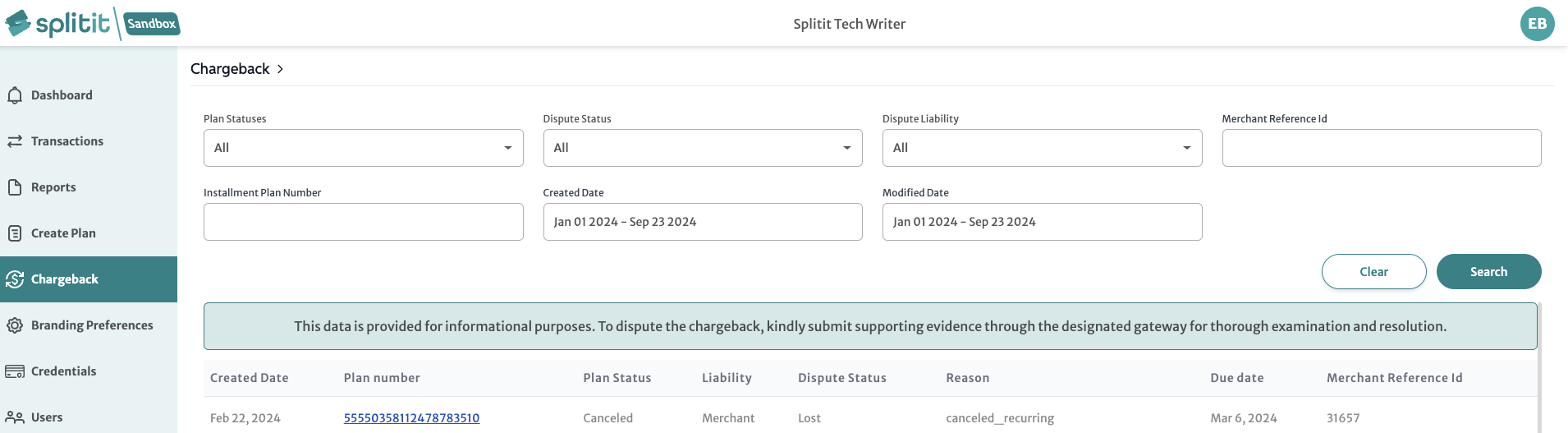

- Log into your Merchant Portal and click on Chargeback on the left-side menu.

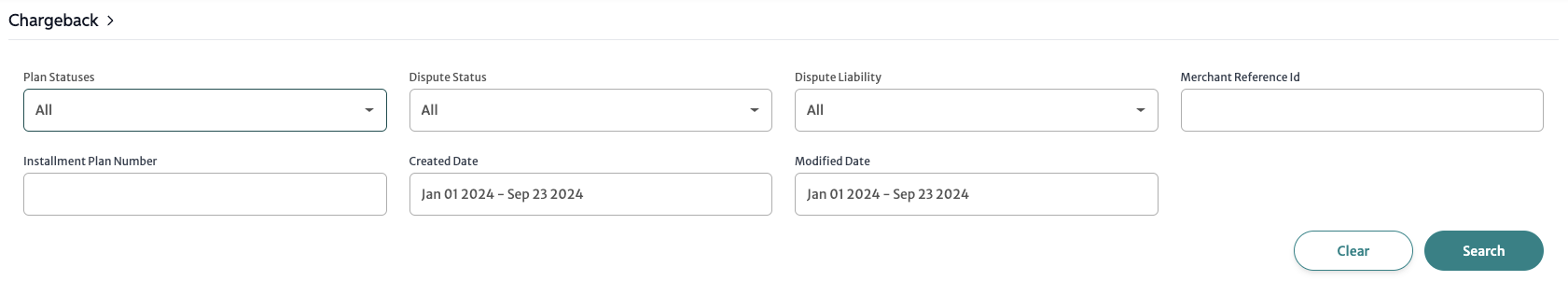

- Use the fields at the top to locate your chargeback, specifying a combination of Dispute Status, Dispute Liability, Reference Id, Installment Plan Number, Created Date and Modified Date. It is likely you can just leave the defaults if the chargeback is recent and you have very few chargebacks.

Click Search.

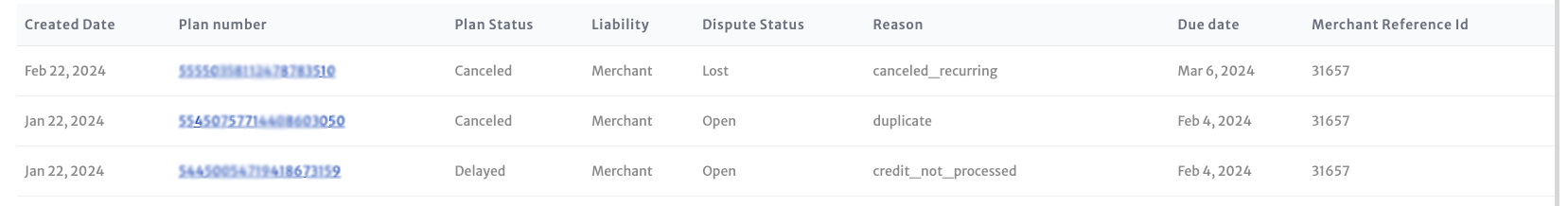

- In the list that appears under the search fields, each chargeback is given its own line (one plan may have multiple chargebacks). Note the Due Date here, which must be adhered to in order to dispute the chargeback. Click on the Plan Number of the chargeback(s) to go to the Transactions screen for that plan.

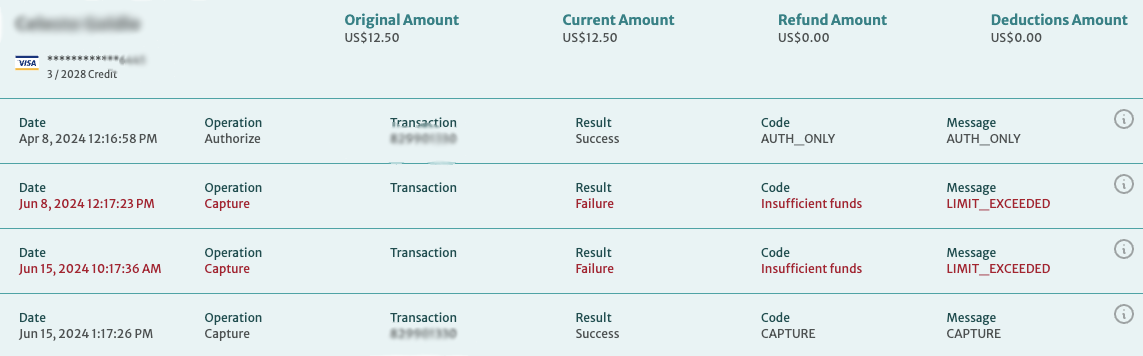

- On the Transactions screen, you can identify the transactions that were charged back by looking for the small hammer icons in the History pane:

As with the non-chargeback transactions, you can click anywhere in a transaction line to open information about the transaction(s).

Dispute Your Chargebacks

Dispute the chargeback through your gateway or chargebacks provider.

Outcomes

Chargeback Initiated

- When a chargeback is initiated by a shopper, a reserve amount consisting of the outstanding plan balance will be collected into a reserve

- Settlement Report: Your Settlement Report will have line items labeled "Chargeback" with a possible fee and "Chargeback Reserve" with the corresponding reserve amount

Chargeback Lost with Additional Chargebacks "Pending Decision"

- If a single chargeback is lost, the plan will be canceled upon receiving the outcome regardless of a win or loss outcome on outstanding chargebacks

- The remaining installments, if applicable, will be canceled, and we will collect the refunded amount from your merchant account and the reserve for the outstanding balance will be returned to you

- Losing even one chargeback will result in the plan's cancellation

- Your Settlement Report will include:

- a line labeled "ChargebackRefund" (-) with the outstanding plan amount due to the chargeback loss

- a line labeled "ChargebackReserve" (+) with the outstanding plan amount returned to you following the collection of the outstanding balance initiated by the refund

Chargeback Lost with NO Additional Chargebacks "Pending Decision"

- If the chargeback is lost, the associated plan will be automatically canceled

- The remaining installments, if applicable, will be canceled, and we will collect the refunded amount from your merchant account and the reserve for the outstanding balance will be returned to you

- Your Settlement Report will include:

- a line labeled "ChargebackRefund" (-) with the outstanding plan amount due to the chargeback loss

- a line labeled "ChargebackReserve" (+) with the outstanding plan amount returned to you following the collection of the outstanding balance initiated by the refund

- Your Settlement Report will include:

Chargeback Won with Additional Chargebacks "Pending Decision"

- The previously collected chargeback amount will be returned to you if a chargeback is won

- In addition, the system will wait for the results of all chargebacks "Pending Decision”

- If all additional chargebacks are "Won", we will return the previously collected chargeback amounts and attempt to capture the plan's outstanding amount

- Your Settlement Report will include:

- a line labeled "ChargebackReverse" with the corresponding amount for any single chargeback that was won

- a line labeled "ChargebackReserve" (+) with the outstanding plan amount returned to you following the successful collection of the outstanding balance initiated by the capture

- Your Settlement Report will include:

Chargeback Won with NO Additional Chargebacks "Pending Decision"

- We will attempt to capture the outstanding amount of the plan

- Your Settlement Report will include a line labeled "ChargebackReserve" (+) with the outstanding plan amount returned to you following the successful collection of the outstanding balance initiated by the capture

Other Processes

Cancel Initiated Due to "Lost" Chargeback

- If a plan is canceled, either due to a lost chargeback or a failed attempt to capture the outstanding amount after winning a chargeback, any outstanding amounts will be collected from your merchant account. You will see a line labeled "ChargebackRefund" in your Settlement Report with the outstanding plan amount

Chargeback Reserve: Holding and Releasing Funds

If a chargeback was initiated on a plan, Splitit will reserve the outstanding balance of that plan until the resolution of all chargebacks and the plan is completed

- Collecting Funds into Reserve

- When a chargeback is initiated on a plan, the outstanding balance will be held in a reserve

- Holding Period

- For the Outstanding Balance held in reserve, the reserve amount is held until all open chargebacks are resolved and the plan is either canceled or captured for the Outstanding Amount

- Releasing Reserve Funds

- A Reserve can be released if the outstanding balance on the plan is either captured or refunded and the plan has been "cleared"

Chargeback Fees

Chargeback fees vary by merchant agreement.

Chargeback Transactions in Your Merchant Reports

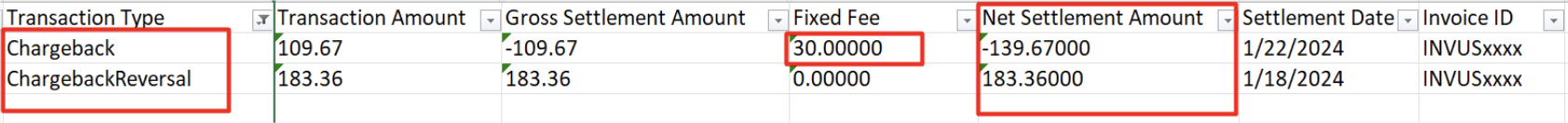

Refer to your Settlement Report (Detail). Net Settlement Amount is money debited or credited to your account. Transaction Type will be either Chargeback or ChargebackReversal.

Definitions

Chargeback Statuses

Open: Chargeback case has been opened for review

Pending: A dispute has been submitted and is awaiting a result

Closed: Chargeback case closed by the shopper or issuer

Lost: Chargeback case ruled in favor of the shopper

Won: Chargeback case ruled in the merchant's favor

Other: Other reasons such as unrecognized

Codes

Visa

| Code | Description |

|---|---|

| 10.3 | Fraudulent Transaction: No Cardholder Authorization |

| 10.4 | Fraudulent Transaction: No Cardholder Authorization |

| 11.3 | Requested/Required Authorization Not Obtained |

| 12.4 | Processing Error |

| 12.5 | Incorrect Amount/Processing Error |

| 13.1 | Merchandise/Services Not Received |

| 13.2 | Cancelled Recurring |

| 13.3 | Not As Described or Defective Merchandise/Services |

| 13.5 | Misrepresentation |

| 13.6 | Credit Not Processed |

| 13.7 | Cancelled Merchandise/Services |

| 1.7.7.3 | Transaction Reversal or Adjustment |

Mastercard

| Code | Description |

|---|---|

| 4808 | Requested/Required Authorization Not Obtained |

| 4812 | Account Number was Not on File |

| 4831 | Transaction Amount Differs |

| 4837 | Fraudulent Transaction: No Cardholder Authorization |

| 4841 | Cancelled Recurring Transaction |

| 4853 | Cardholder Dispute Defective/Not as Described |

| 4855 | Nonreceipt of Merchandise/Goods or Services Not Delivered |

FAQs

How long does the chargeback process take?

The chargeback process timeline varies depending on several factors, including the reason for the chargeback, the card network involved, and the efficiency of the parties involved in the resolution process. Typically, it can take up to 120 days.

How can I prevent chargebacks in the future?

Preventing chargebacks involves a combination of proactive measures, effective communication, and adherence to best practices including:

- Clear product descriptions

- Transparent billing descriptors

- Secure payment processing

- Excellent customer service

- Clear refund policy

Glossary

Capture Date: The date when a transaction is processed

Chargeback: A reversal of a transaction, initiated by the cardholder's bank, usually due to a dispute over the transaction

Chargebacks "Pending Decision": This indicates that the review process for the initiated chargeback is ongoing. The issuing bank, acquiring bank, and possibly the merchant are examining the details of the dispute to determine its validity and decide whether the chargeback will be upheld or rejected

Chargeback Reverse: A term used to describe the process in which a previously disputed transaction, initially refunded to the customer through a chargeback, is resolved in favor of the merchant. Consequently, the funds are returned to the merchant's account

Holding Period: The "Holding Period" refers to the duration during which a reserve amount, is held to mitigate the risk of a chargeback. During this time, the funds are not accessible to the merchant. This period typically lasts 120 days, ensuring that any potential chargeback claims can be processed and resolved before the reserved funds are released to the merchant

Reserve: A portion of funds held back from the merchant to cover potential chargebacks or disputes