Splitit Go

Splitit Go lets you start plans directly in a web portal, sending a link to your shopper by email, SMS, QR Code, or URL. The link directs them to a form where they can checkout, or you can fill out the form for the shopper using the Phone Order option. Note that for plans with more than one installment, you are also able to add a required deposit to start the plan (and can configure it differently for each plan).

Start an installment plan using Splitit Go by following the instructions below:

Login

- Proceed to Splitit Go, select New Transaction. Log in with your business account using Google/Apple or your email (you can also sign up for an account here).

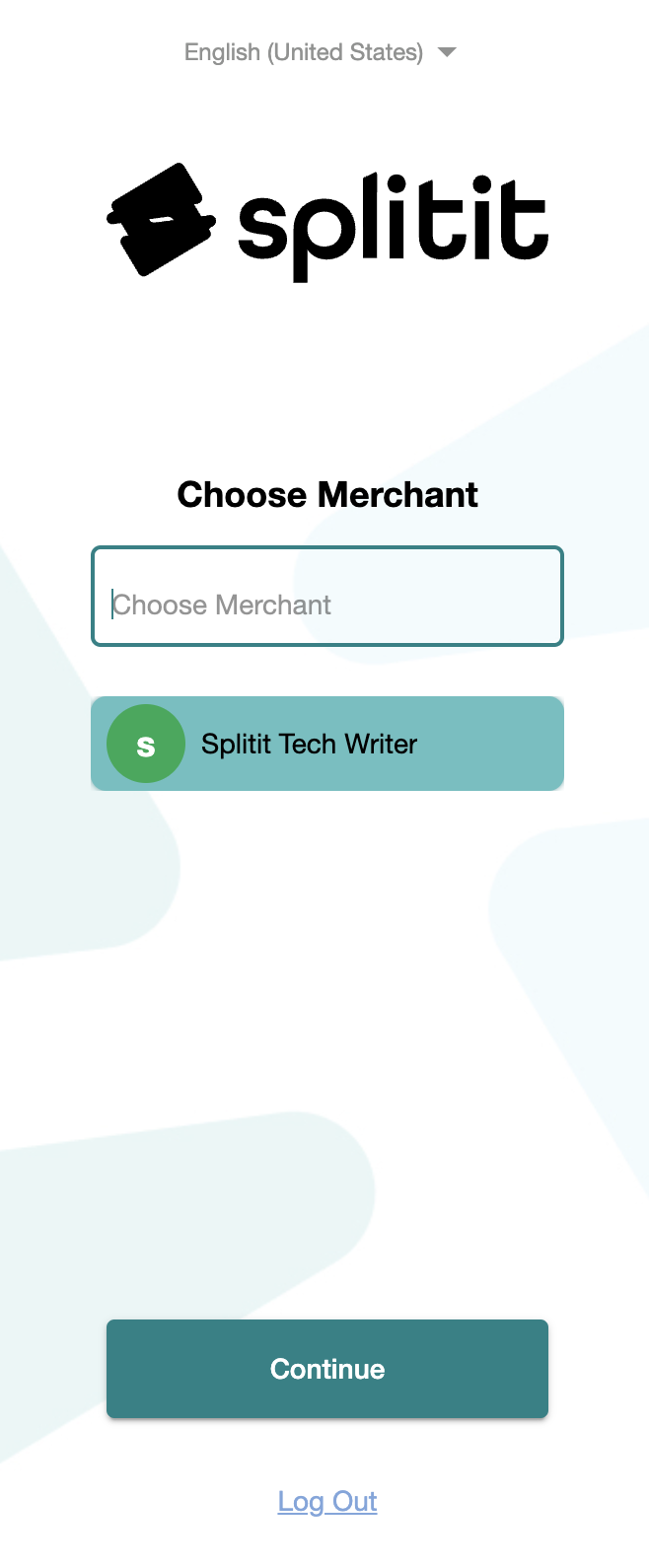

- Choose the merchant from your account that you’d like to use then click Continue. Next choose the Store/Gateway associated with your account that you'd like to use, and click Continue again.

Set Up An Installment Plan

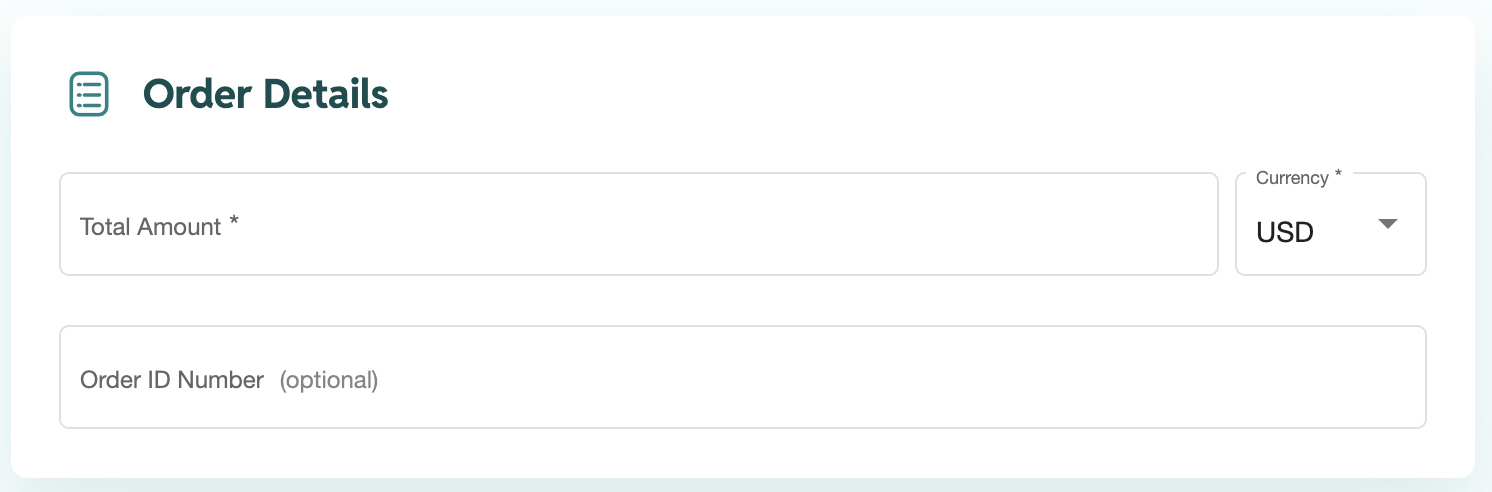

- On the next page, enter the Total Amount of the order, select a currency (if applicable), and add an Order ID Number (if applicable).

- If necessary, change the language for the shopper’s interface (Shopper Language).

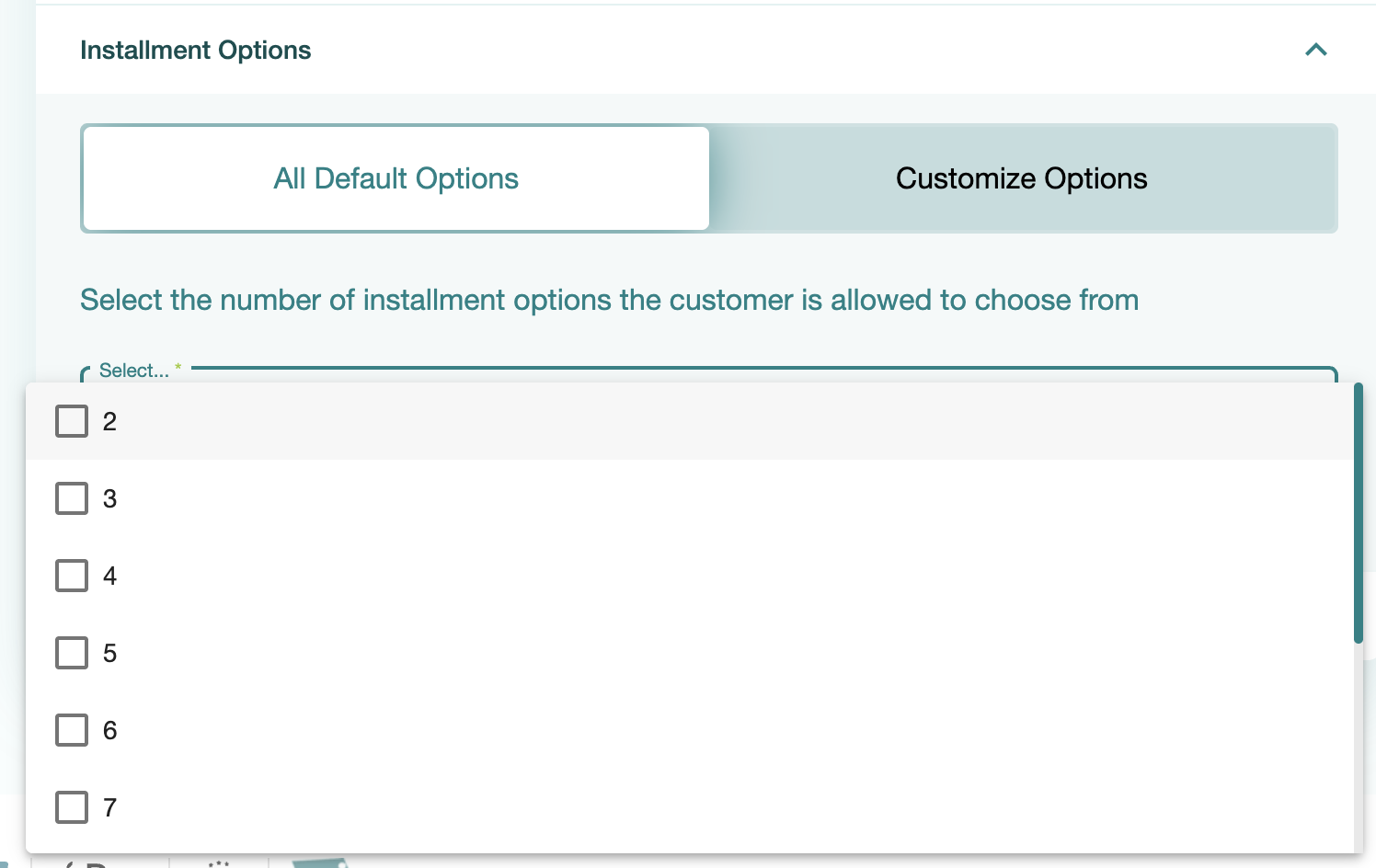

- You can also set the Installment Options you’d like, leaving either All Default Options (defaults are set by Splitit support), or selecting Customize Options, which lets you choose the options you’d like to present to this particular plan with checkboxes.

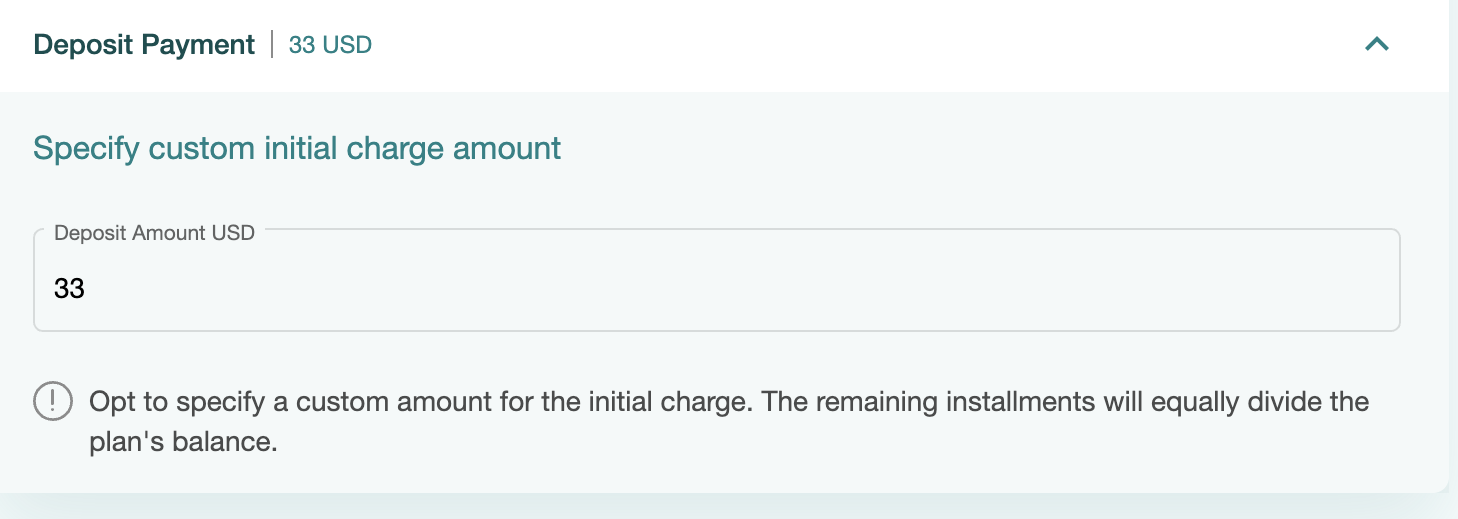

- Finally, you can optionally add a Deposit Payment amount, which will be captured immediately from the shopper. This is not the first installment payment, rather the installments will be calculated based on the total amount less this deposit payment amount. The deposit payment is set individually for each plan and works for all link types.

- When you are finished, click Continue.

Send Checkout Form to Your Shopper

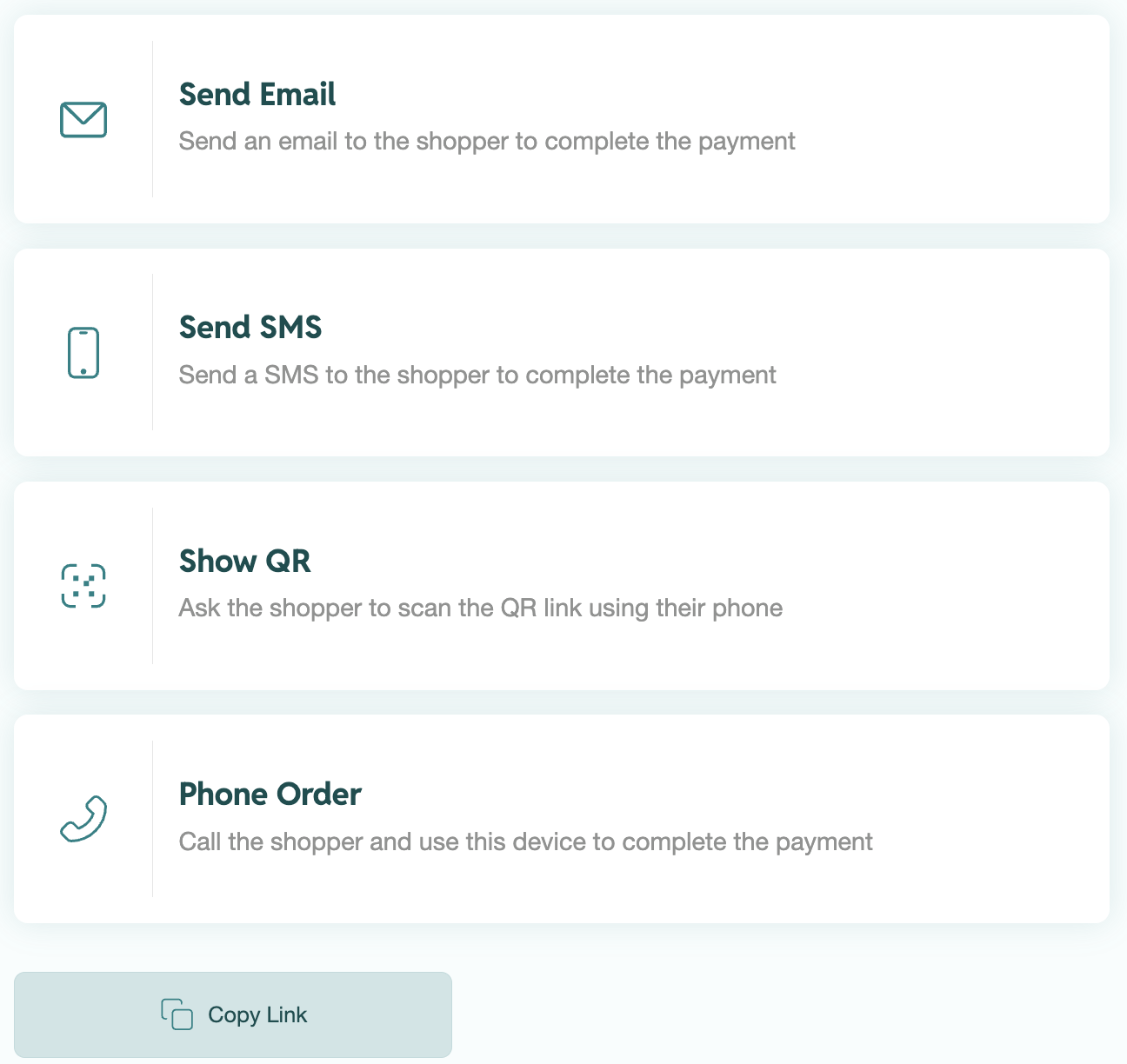

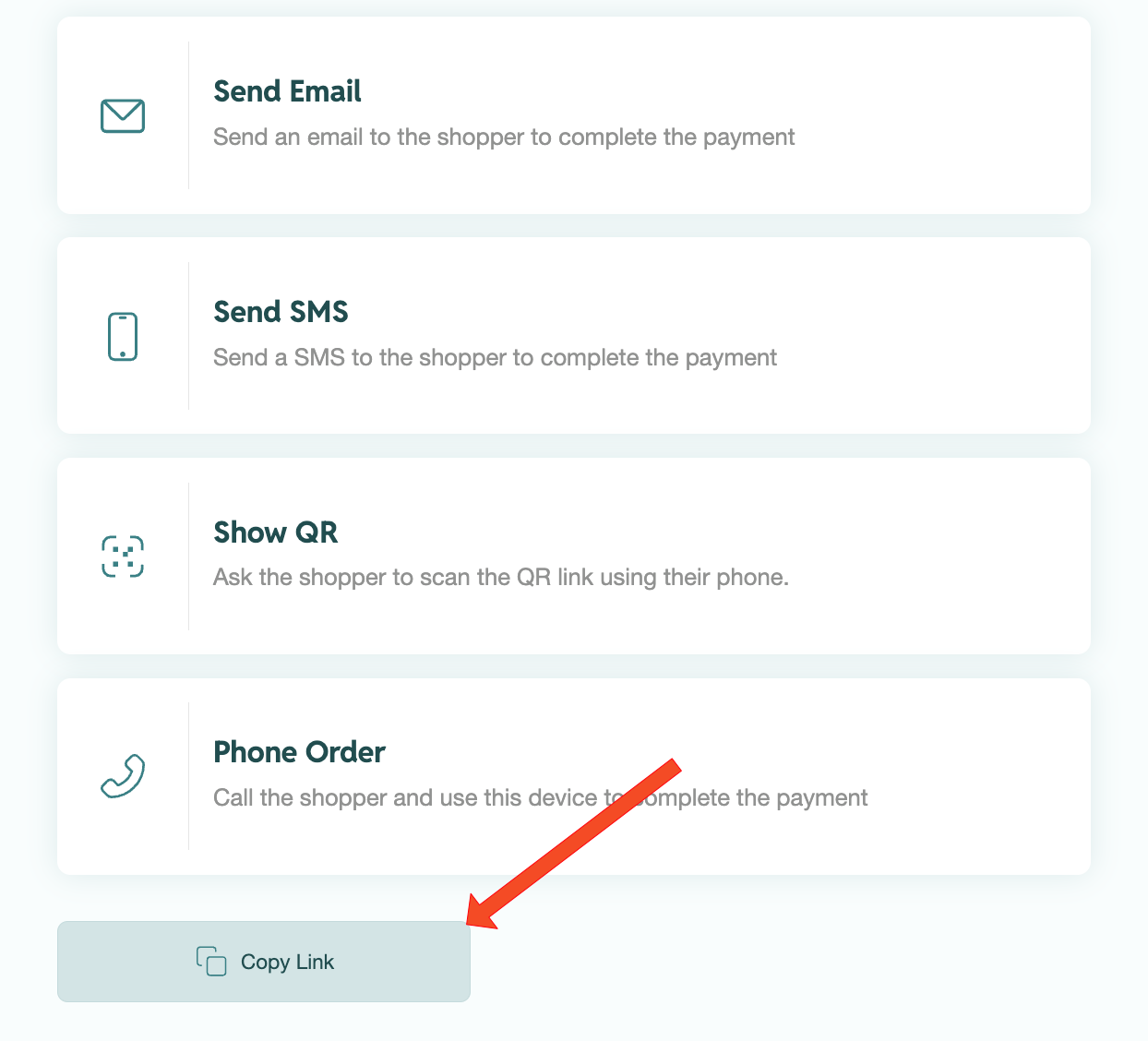

Next, you will see five options you can use to present the checkout form to your shopper:

- Send Email

- Send SMS

- Show QR

- Phone Order

- Copy Link

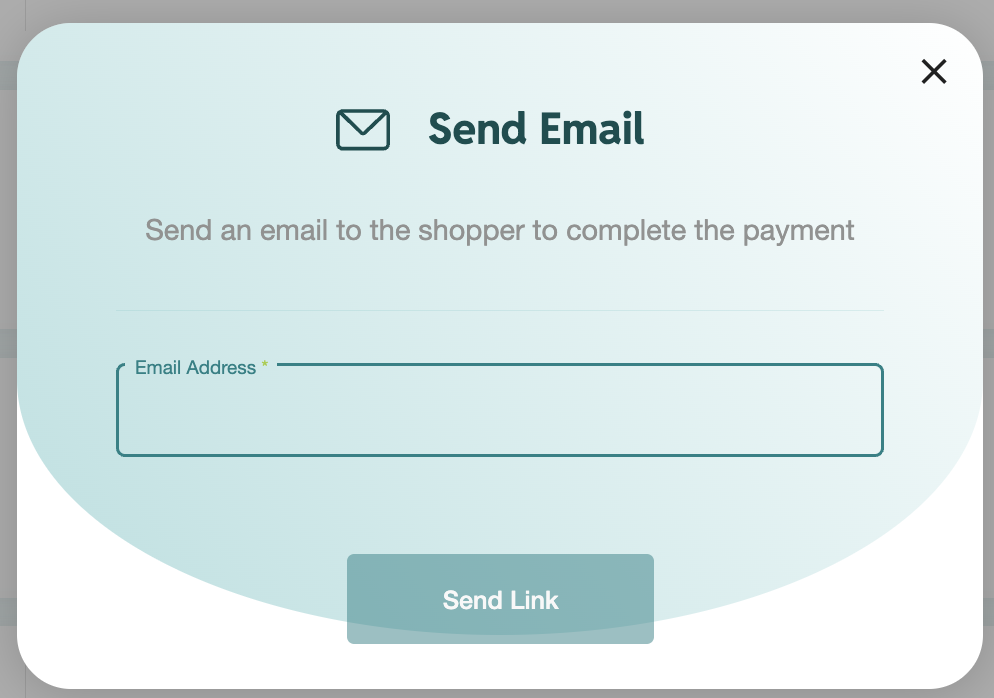

Send Email Instructions

- Click Send Email, enter the shopper’s email address and click Send Link.

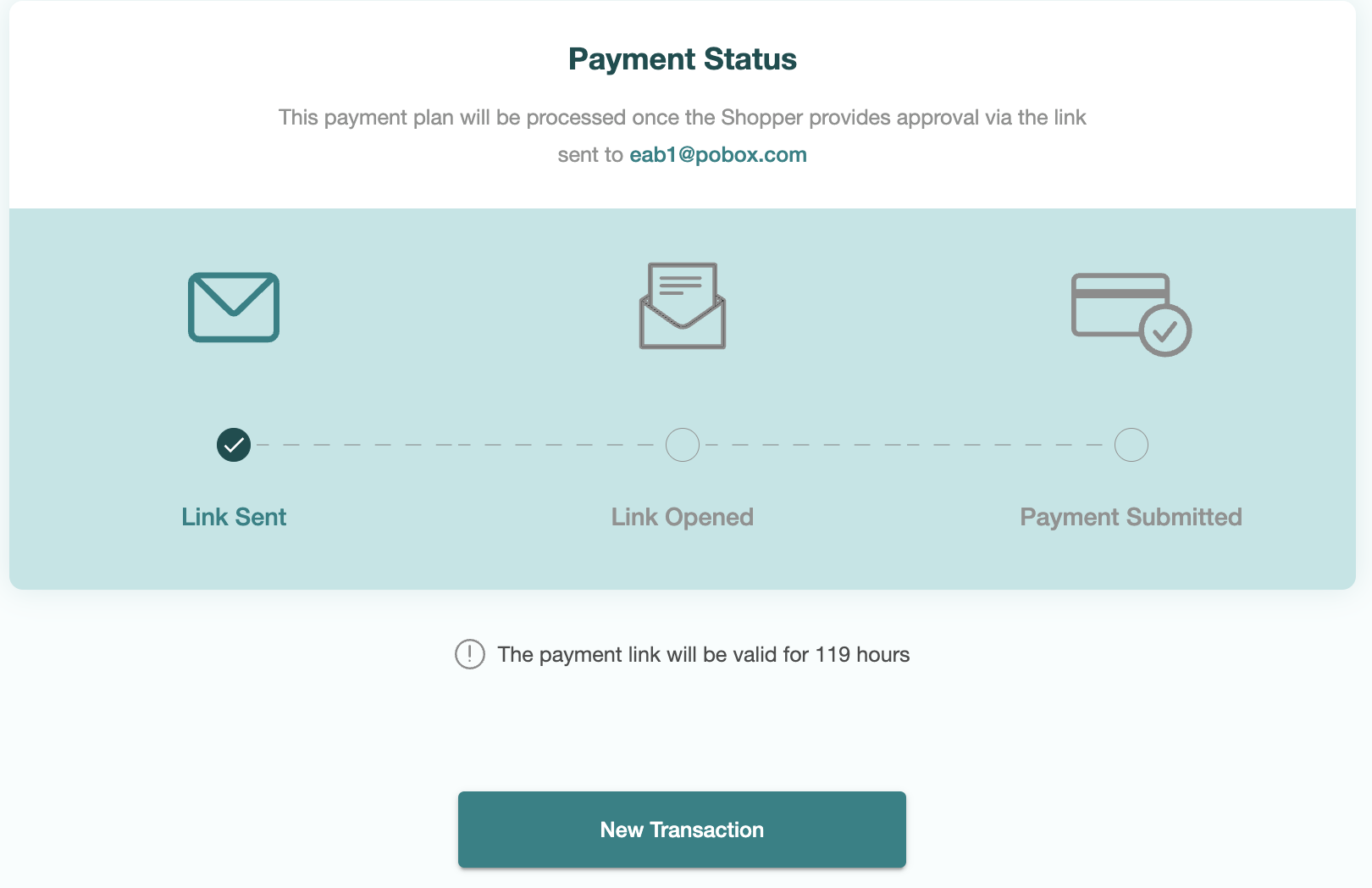

- You'll be able to track Payment Status in the UI.

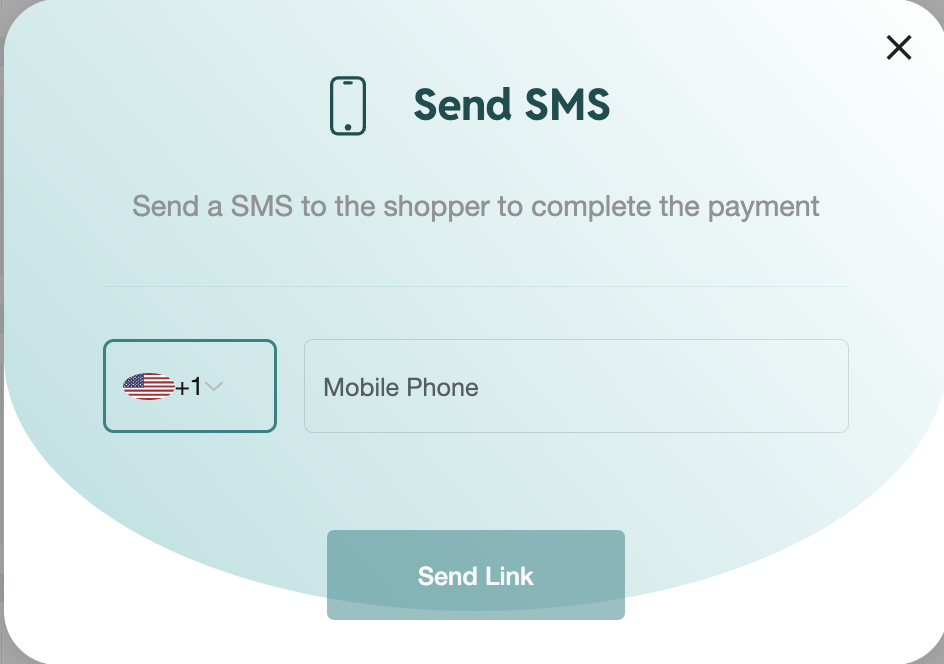

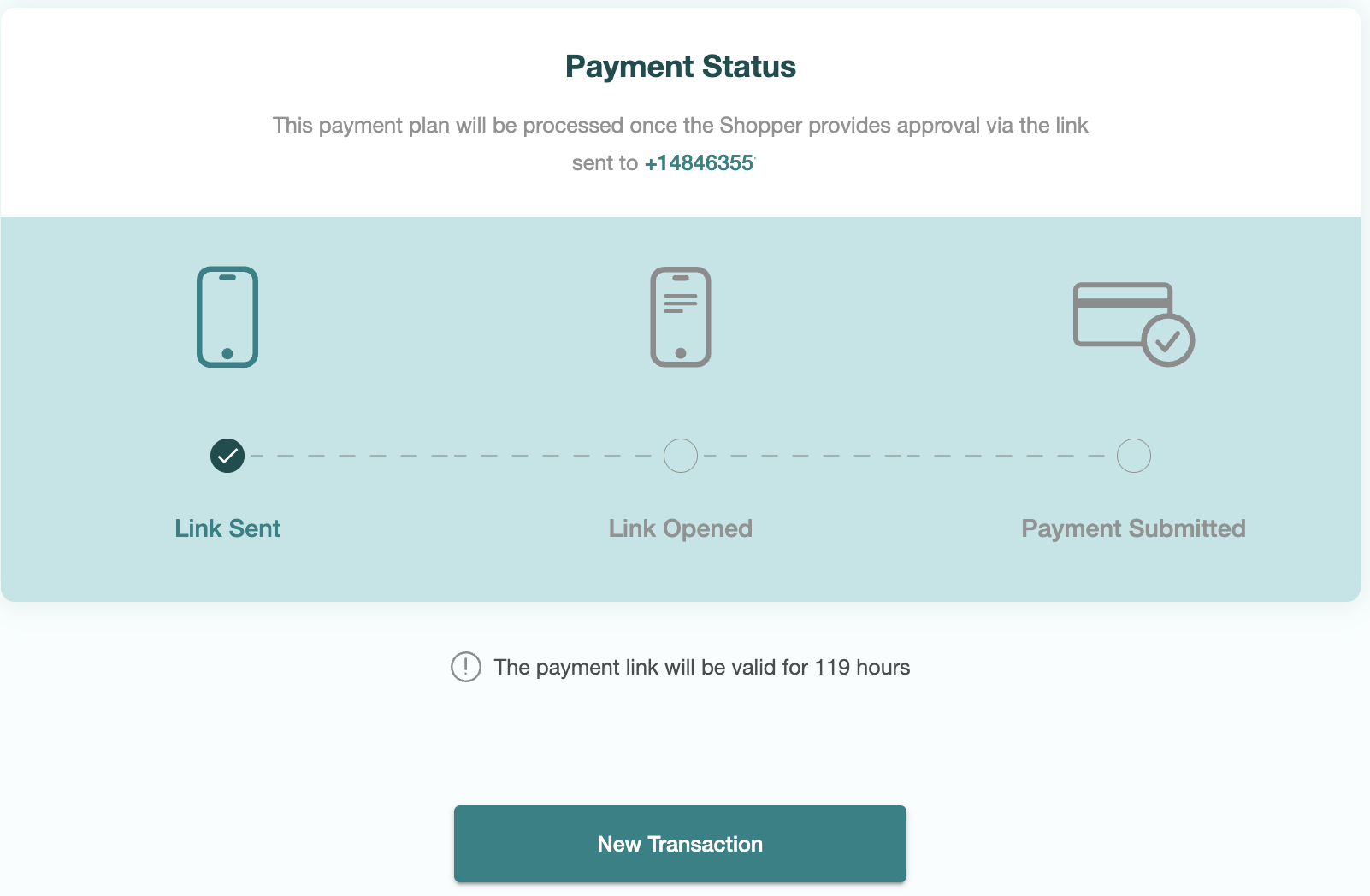

Send SMS Instructions

- Click Send SMS, enter the shopper’s cellphone number, then click Send Link.

- You’ll be able to track Payment Status in the UI.

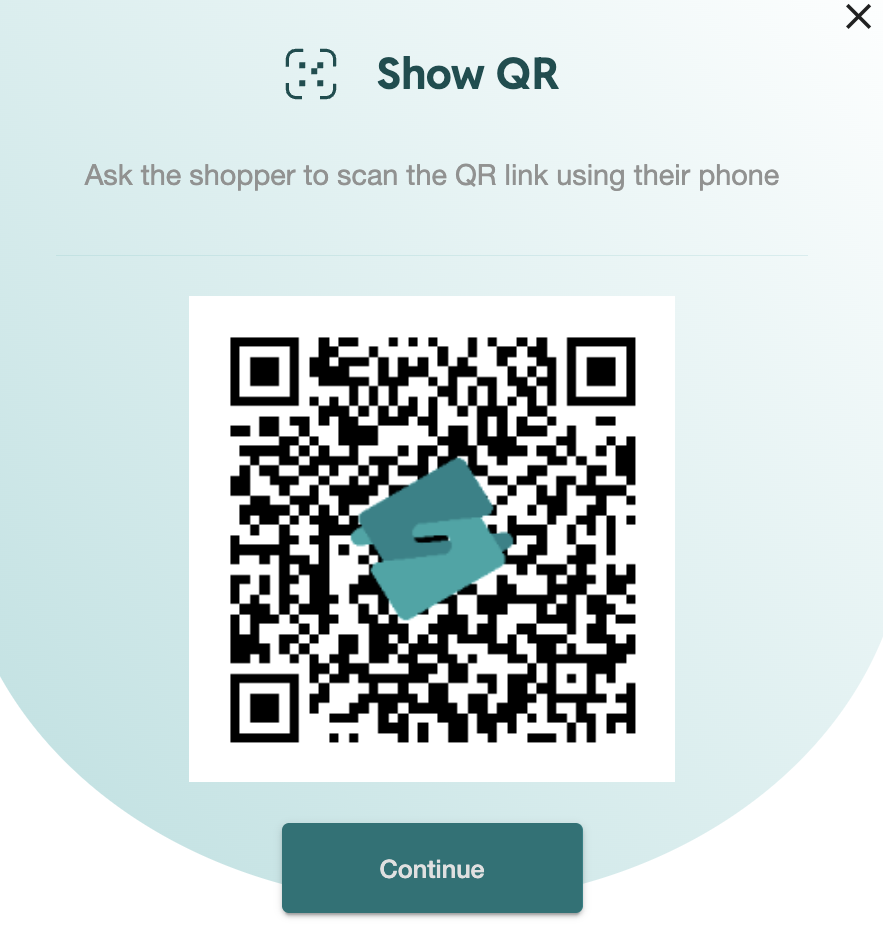

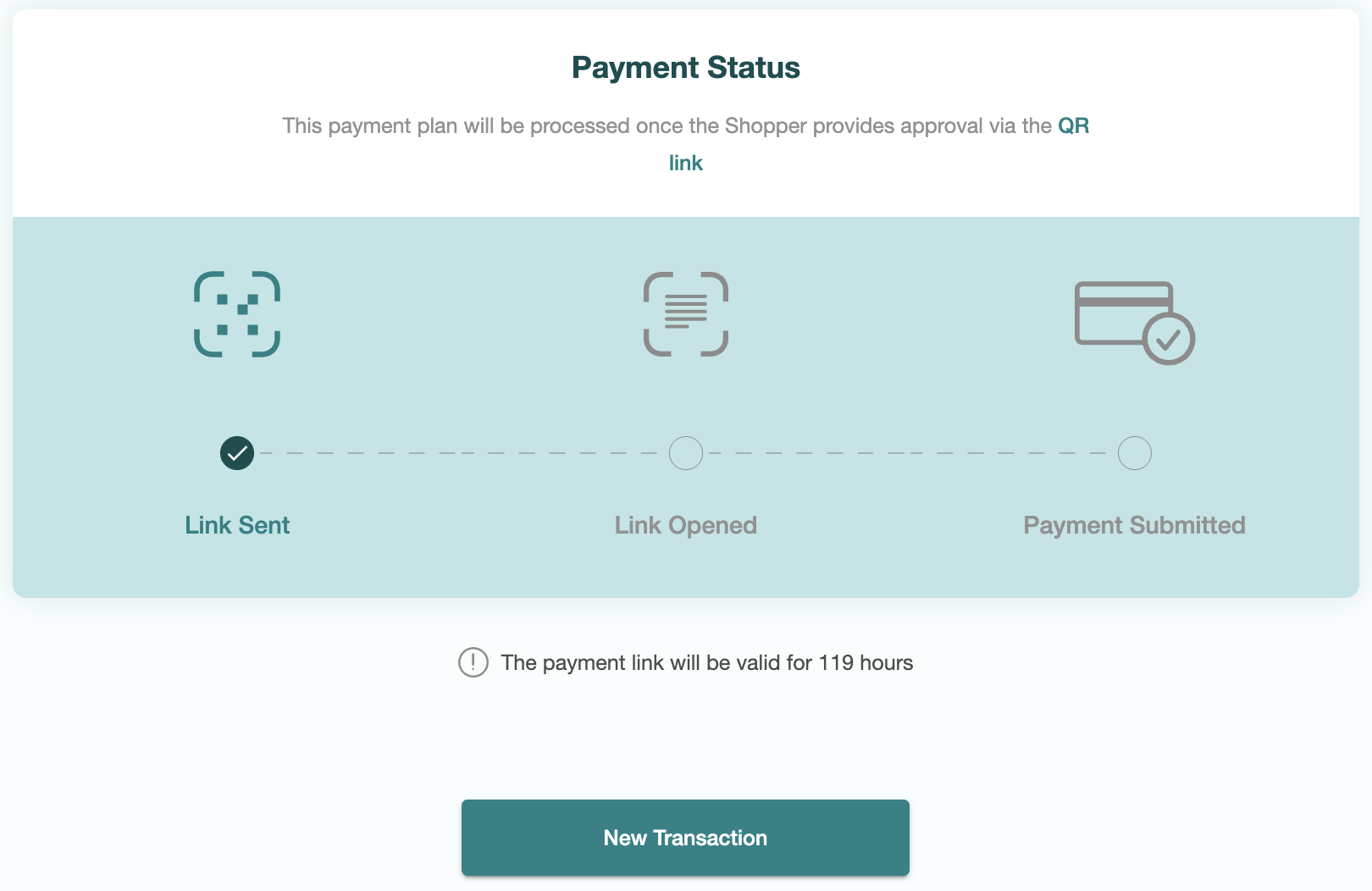

Show QR Instructions

- Click Show QR and have the shopper scan the QR link with their phone. Click Continue.

- You’ll be able to track Payment Status in the UI.

Phone Order Instructions

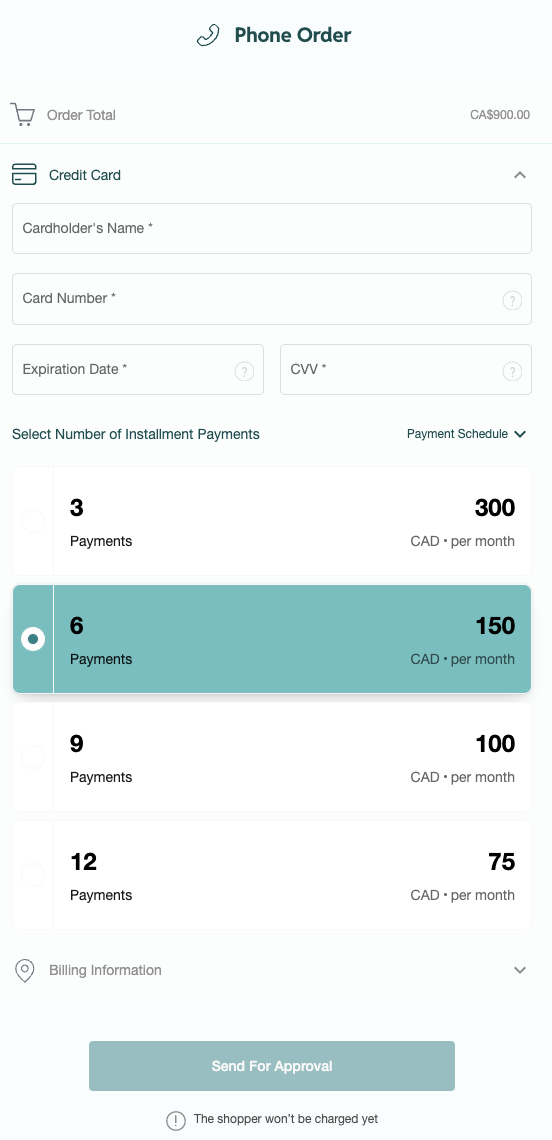

- Click Phone Order. Call the shopper and fill out the provided form for them, including credit card information, number of installments, and billing information (click the dropdown for billing information).

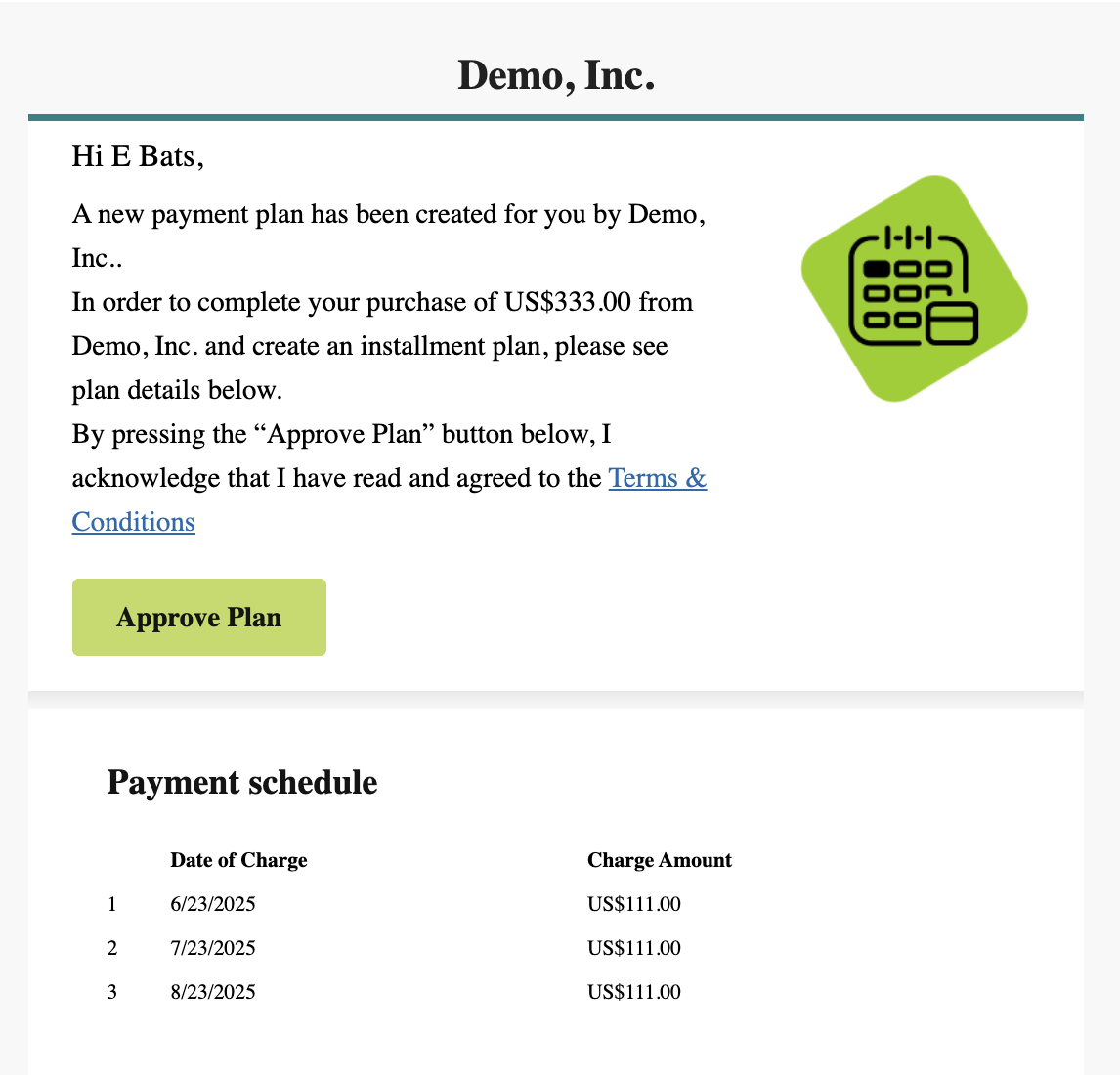

- Click Send for Approval (the shopper won't be charged yet). The shopper will receive an email to approve the plan:

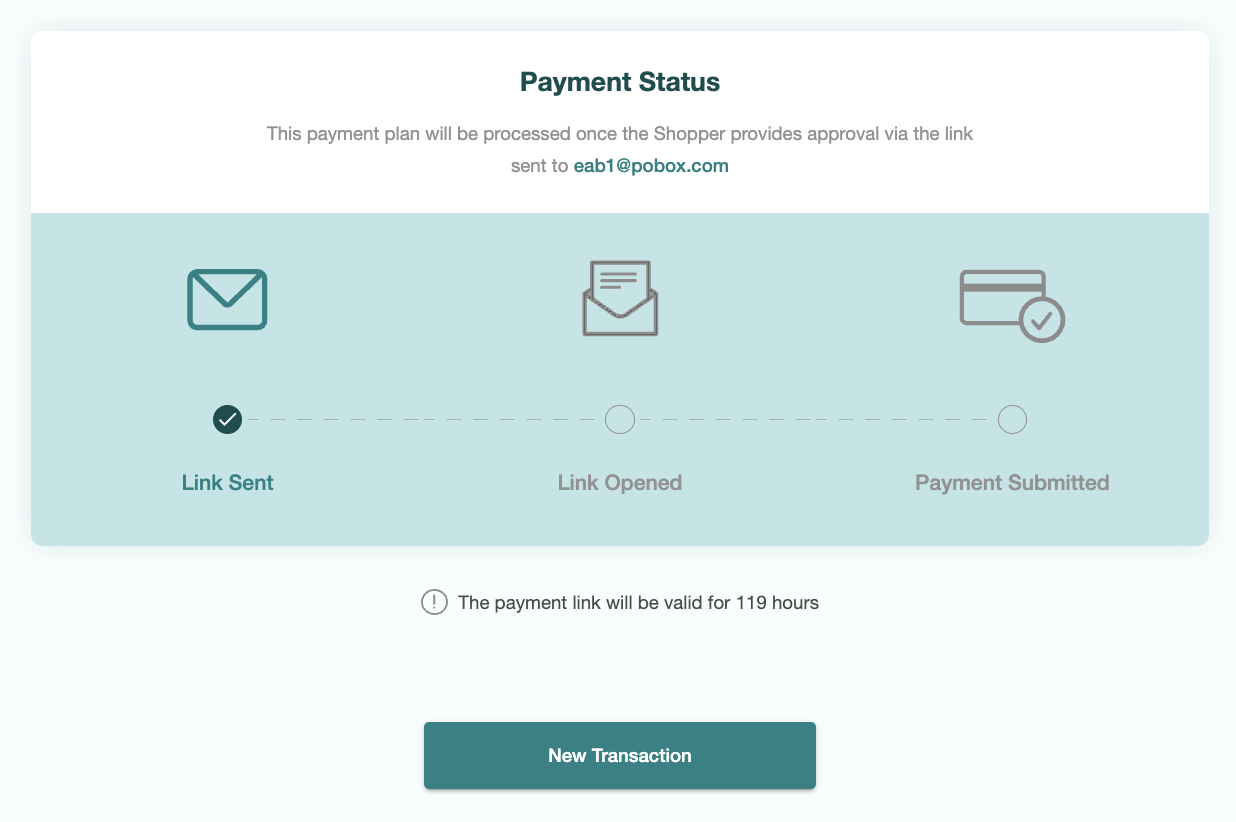

- You can track the plan's status in the UI:

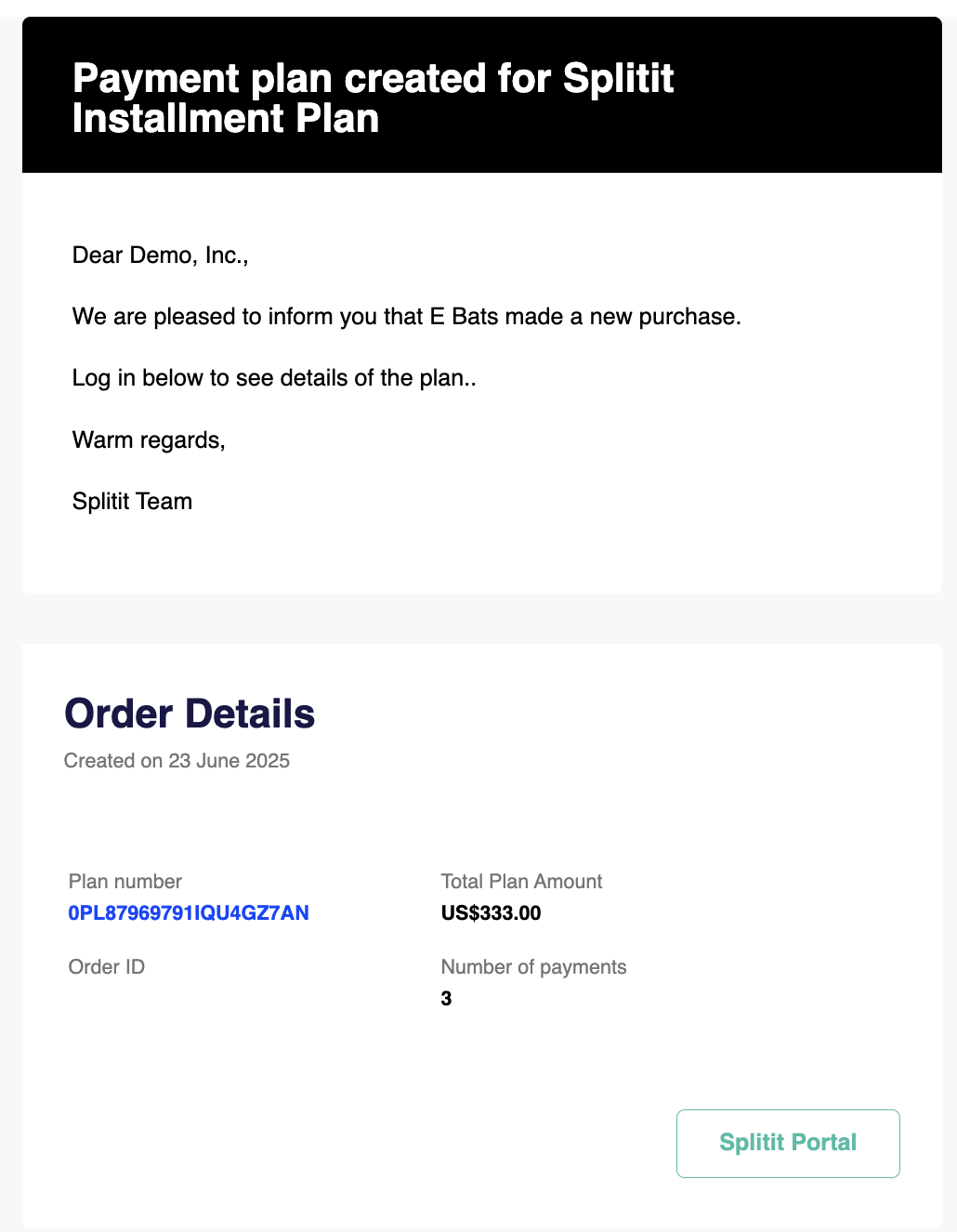

- Once the plan is approved, you will receive an email:

Copy Link Instructions

- Click Copy Link to simply get a payment form URL to give to your shopper.

Selling Splitit: Best Practices

For guidelines on how to best approach selling Splitit, please see below.

- Maximize Your Sales Potential

- Sales Call Structure

- Sales Script Suggestions

- FAQs

Showcase Splitit on Your Website

- Clearly display installment payment information on your site to inform customers early about the option to spread payments monthly. This creates awareness and ensures customers know they can obtain your product more affordably.

Introduce Splitit Early in Conversations

- Highlight the payment option early in your sales process. This helps ease discussions around price, reducing friction and increasing conversion rates at checkout.

Focus on the Ideal Customer Profile

- Target customers who can charge the purchase to their credit card but hesitate due to the large upfront cost. Splitit allows them to spread payments over time, addressing their concerns without introducing new debt.

Leverage Our Unique Differentiators

- Not New Financing: Customers use their existing credit cards, so there's no need for a new application.

- Fast and Easy: No approvals, credit checks, or lengthy processes.

- Maximize Rewards: Customers continue earning credit card rewards and offers, all without paying interest.

With Splitit, you're offering a smart, flexible payment option that simplifies purchasing decisions and helps close more deals.

Start with Questions

- We have easy payment options that don’t require an application or approval, would you like to try Splitit?

- We have Splitit, which allows you to pay for this item in monthly installments, would you like to use that?

- Are you looking for a payment option that won’t need an application, approval, or taking a new loan?

Share the Value Proposition

- Works just like a regular credit card purchase—except that only a fraction of the price hits your card each month.

- The average consumer has over 70% of their credit card limit available.

- Avoids Interest from putting the full balance on the card and not paying off immediately.

- No application.

- No credit check.

- No additional debt.

The Details

- Paying with Splitit offers better management of your budget by reserving the amount from your existing credit line and allowing you to use your cash flow for other purchases.

- When you make your purchase using Splitit, your credit card is authorized and then charged for your first installment straightaway or when the goods are shipped. Subsequent monthly installments are automatically taken on this date each month. At the same time, an authorization (hold) is taken for the total amount remaining. This is a temporary hold during which time your available credit is reduced by the authorization amount. The amount on hold is released back into your available funds on your credit card within 30 days (often shorter).

- You must maintain sufficient available credit on your credit card for the monthly installment amounts.

- Your standard credit card terms and conditions still apply.

B2B Script:

"Splitit enables you to preserve the cash in your bank account for business-critical expenses such as wages, rent, inventory, and other investments that can only be paid via cash/EFT. With Splitit, you don't need to repay $4,000 on your credit card in the next month to avoid 20% penalty card interest from your bank, you only need to repay $440. You can repay the plan early too, at no cost."

B2C Script:

"Splitit enables you to preserve the cash in your bank account for critical expenses such as home loan repayments, car leases, and rent that can only be paid via cash/EFT. With Splitit, you don't need to repay $4,000 on your credit card in the next month to avoid 20% penalty card interest from your bank, you only need to repay $440. You can repay the plan early too."

How does Splitit work?

- At the time of the purchase, the first installment is captured and the remaining plan balance is placed on hold. The hold will be released within the next 30 days. Then, each month, according to the shopper’s payment plan, the installment amount is collected.

- Here is an example of how the service works for a customer buying a TV totaling $1,000 in five installments of $200 each:

- Splitit obtains authorization from the credit card company for the remaining balance of the plan $800. This is not a charge on the card.

- The credit card company then charges the shopper $200 for the first payment.

- During the second month, the shopper will be charged the second installment of $200.

Does this affect my credit score?

- No. If you use a Splitit installment plan, there is no impact on your credit score. The bank simply sees the individual installment charges each month.

What if I don’t have the available credit on one card for the full amount of the purchase?

- We can take two cards and create two payment plans to cover the full amount.

- You can have the shopper call the bank and ask for an extended line of credit if they have been good cardholders.

How do I receive a report of my installments?

- When you make a purchase using Splitit, you will be asked to provide your email. Splitit sends you credentials so you can log into the Splitit shopper portal to check your installment status and view other information regarding your purchase.

Can I pay off my installments early?

- Yes, you can. This option is available on your Splitit shopper portal or you can contact our customer care at support@splitit.com.

What if my credit card gets lost or stolen? If something happens to your credit card, please do the following:

- Contact your card company to report the card lost.

- Visit your Splitit shopper portal and update your payment plan with another credit card.

- If you are having any trouble, please email support@splitit.com.

Why don’t you allow debit? [if applicable]

- Allowing an installment plan to run on a debit card, where authorizations cannot be held for an extended period of time, poses a greater risk for everyone. At this time, the current infrastructure cannot accept debit cards for that reason.

More FAQs can be found on our support website.