Splitit Go

Start an installment plan using the Splitit Go web portal by following the instructions below.

Login

- Proceed to Splitit Go, select New Transaction, then log in with your business account using Google or email (you can also sign up for an account here).

- (Optional) Choose the merchant associated with your email address that you’d like to use then click Continue.

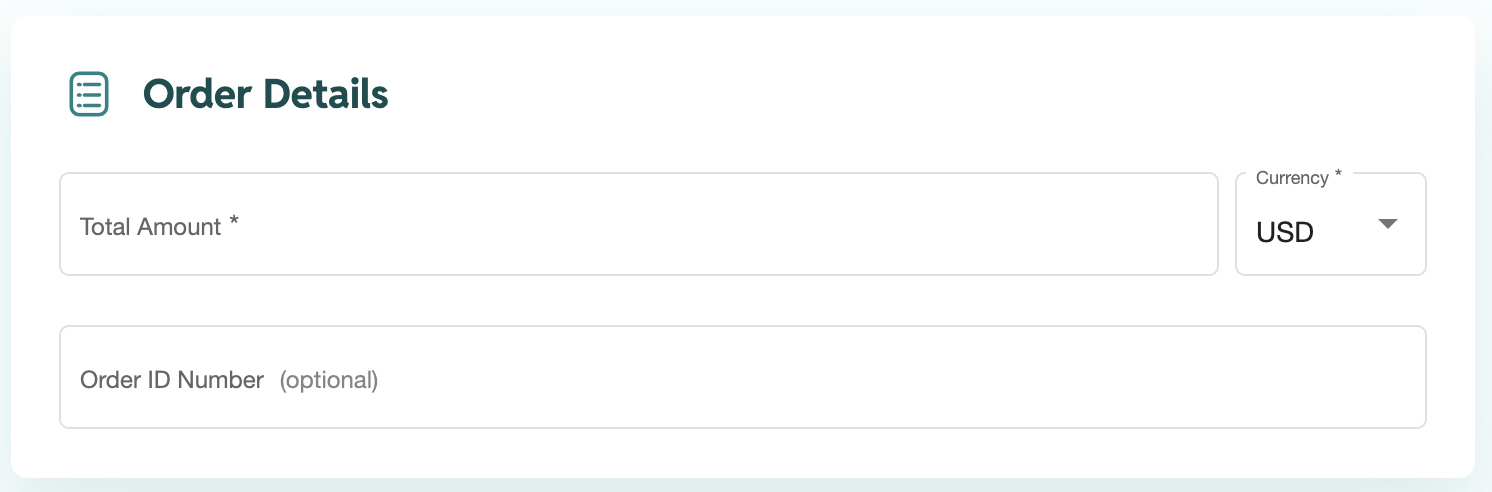

Order Details

- Enter the Total Amount of the order, select a currency (if applicable), and add an Order ID Number (if applicable).

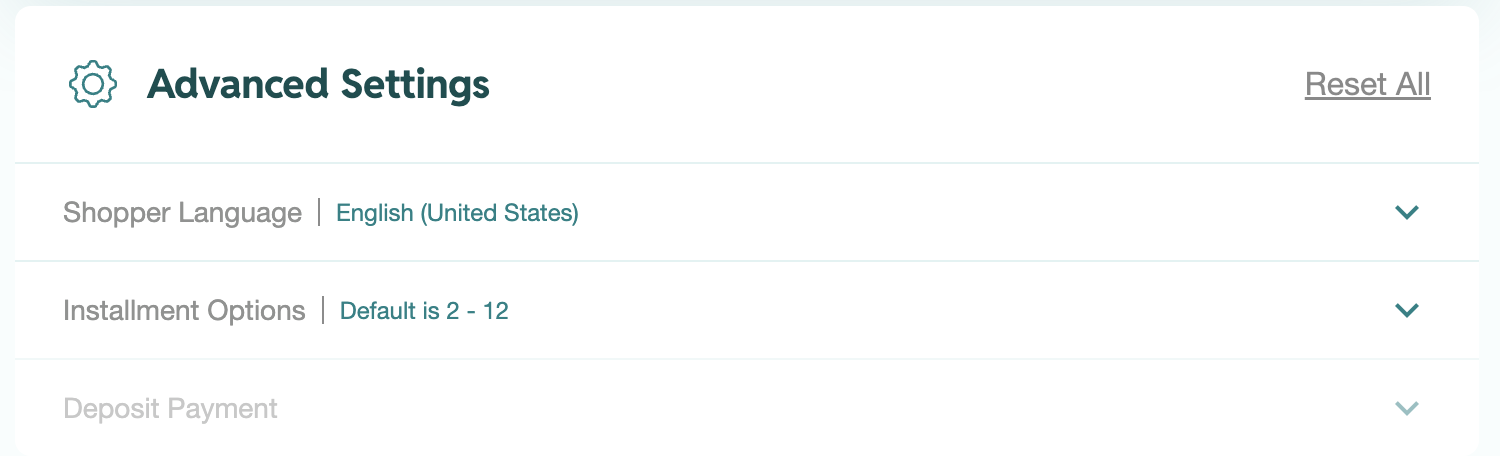

Advanced Settings

- Under Advanced Settings, you can set language for the shopper’s interface (Shopper Language).

- You can also set the Installment Options you’d like, selecting either All Default Options (which will present 2-12 payments), or Customize Options, which lets you choose the options you’d like to present with checkboxes).

- Finally, you can add a Deposit Payment amount, which will be captured immediately from the customer. This is not the first payment, rather the installments will be calculated based on the total amount less this deposit payment amount.

- When are finished, click Continue.

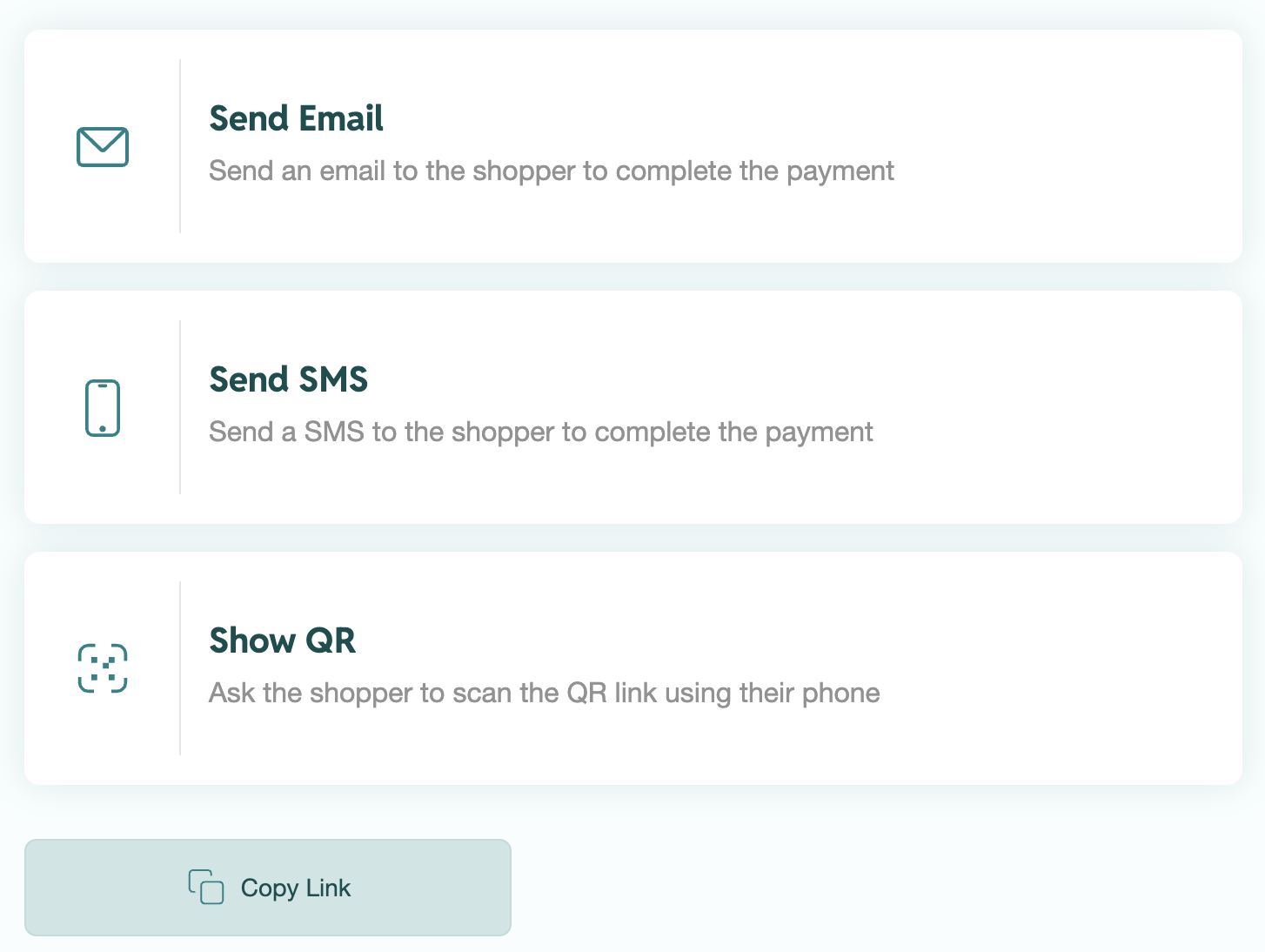

Plan Presentation Options

You will see five options you can use to present the installment plan options to your shopper:

- Send Email

- Enter the customer’s email address and click Send Link. You’ll be able to track Payment Status in the UI.

- Send SMS

- Enter the customer’s cellphone number to send them an SMS. You’ll be able to track Payment Status in the UI.

- Show QR

- Display a QR code that can customer can scan. After they have scanned it, click Continue to track Payment Status.

- Copy Link

- Email the customer a link they can use to check themselves out with. You’ll be able to see Payment Status in the UI.

Selling Splitit: Best Practices

For guidelines on how to best approach selling Splitit, please see below.

- Maximize Your Sales Potential

- Sales Call Structure

- Sales Script Suggestions

- FAQs

Showcase Splitit on Your Website

- Clearly display installment payment information on your site to inform customers early about the option to spread payments monthly. This creates awareness and ensures customers know they can obtain your product more affordably.

Introduce Splitit Early in Conversations

- Highlight the payment option early in your sales process. This helps ease discussions around price, reducing friction and increasing conversion rates at checkout.

Focus on the Ideal Customer Profile

- Target customers who can charge the purchase to their credit card but hesitate due to the large upfront cost. Splitit allows them to spread payments over time, addressing their concerns without introducing new debt.

Leverage Our Unique Differentiators

- Not New Financing: Customers use their existing credit cards, so there's no need for a new application.

- Fast and Easy: No approvals, credit checks, or lengthy processes.

- Maximize Rewards: Customers continue earning credit card rewards and offers, all without paying interest.

With Splitit, you're offering a smart, flexible payment option that simplifies purchasing decisions and helps close more deals.

Start with Questions

- We have easy payment options that don’t require an application or approval, would you like to try Splitit?

- We have Splitit, which allows you to pay for this item in monthly installments, would you like to use that?

- Are you looking for a payment option that won’t need an application, approval, or taking a new loan?

Share the Value Proposition

- Works just like a regular credit card purchase—except that only a fraction of the price hits your card each month.

- The average consumer has over 70% of their credit card limit available.

- Avoids Interest from putting the full balance on the card and not paying off immediately.

- No application.

- No credit check.

- No additional debt.

The Details

- Paying with Splitit offers better management of your budget by reserving the amount from your existing credit line and allowing you to use your cash flow for other purchases.

- When you make your purchase using Splitit, your credit card is authorized and then charged for your first installment straightaway or when the goods are shipped. Subsequent monthly installments are automatically taken on this date each month. At the same time, an authorization (hold) is taken for the total amount remaining. This is a temporary hold during which time your available credit is reduced by the authorization amount. The amount on hold is released back into your available funds on your credit card within 30 days (often shorter).

- You must maintain sufficient available credit on your credit card for the monthly installment amounts.

- Your standard credit card terms and conditions still apply.

B2B Script:

"Splitit enables you to preserve the cash in your bank account for business-critical expenses such as wages, rent, inventory, and other investments that can only be paid via cash/EFT. With Splitit, you don't need to repay $4,000 on your credit card in the next month to avoid 20% penalty card interest from your bank, you only need to repay $440. You can repay the plan early too, at no cost."

B2C Script:

"Splitit enables you to preserve the cash in your bank account for critical expenses such as home loan repayments, car leases, and rent that can only be paid via cash/EFT. With Splitit, you don't need to repay $4,000 on your credit card in the next month to avoid 20% penalty card interest from your bank, you only need to repay $440. You can repay the plan early too."

How does Splitit work?

- At the time of the purchase, the first installment is captured and the remaining plan balance is placed on hold. The hold will be released within the next 30 days. Then, each month, according to the shopper’s payment plan, the installment amount is collected.

- Here is an example of how the service works for a customer buying a TV totaling $1,000 in five installments of $200 each:

- Splitit obtains authorization from the credit card company for the remaining balance of the plan $800. This is not a charge on the card.

- The credit card company then charges the shopper $200 for the first payment.

- During the second month, the shopper will be charged the second installment of $200.

Does this affect my credit score?

- No. If you use a Splitit installment plan, there is no impact on your credit score. The bank simply sees the individual installment charges each month.

What if I don’t have the available credit on one card for the full amount of the purchase?

- We can take two cards and create two payment plans to cover the full amount.

- You can have the shopper call the bank and ask for an extended line of credit if they have been good cardholders.

How do I receive a report of my installments?

- When you make a purchase using Splitit, you will be asked to provide your email. Splitit sends you credentials so you can log into the Splitit shopper portal to check your installment status and view other information regarding your purchase.

Can I pay off my installments early?

- Yes, you can. This option is available on your Splitit shopper portal or you can contact our customer care at support@splitit.com.

What if my credit card gets lost or stolen? If something happens to your credit card, please do the following:

- Contact your card company to report the card lost.

- Visit your Splitit shopper portal and update your payment plan with another credit card.

- If you are having any trouble, please email support@splitit.com.

Why don’t you allow debit? [if applicable]

- Allowing an installment plan to run on a debit card, where authorizations cannot be held for an extended period of time, poses a greater risk for everyone. At this time, the current infrastructure cannot accept debit cards for that reason.

More FAQs can be found on our support website.