Chargebacks (Managed Merchants)

This document describes chargebacks for Managed Merchants.

Overview

A chargeback happens when a customer disputes a transaction with their bank or credit card company, leading to a reversal of the payment.

In a traditional single-payment transaction, you may only face one chargeback for the total amount. With the Splitit installment solution, each installment is susceptible to individual chargebacks. Despite this difference, the chargeback process, including the submission of evidence, remains consistent for both transaction types.

Key Things to Know:

- Shoppers generally have 120 days to file a chargeback after a purchase is made

- The merchant owns the risk for chargebacks (except for a few anomalous cases)

Common Reasons for Chargebacks

Unauthorized Transactions: If a cardholder notices a transaction on their statement that they did not authorize, they may initiate a chargeback

Non-Delivery of Goods or Services: If the cardholder paid for a product or service that was not delivered as promised, they might file a chargeback

Dissatisfaction with a Product or Service: If a received item or service is significantly different from what was described by a merchant, the cardholder may dispute the charge

Fraudulent Transactions: In cases of identity theft or credit card fraud, the legitimate cardholder may dispute charges made without their knowledge or consent

Splitit's Chargeback Policy

Splitit does not assume liability for amounts that are charged back.

When a dispute is filed, Splitit will immediately debit from your account into a reserve the corresponding chargeback amount, outstanding plan balance, and any at-risk funds from past charges. If all chargebacks are won and the shopper is successfully charged, you will be credited the full reserve amount. Otherwise, only the chargeback amount will be credited. If any chargeback is lost, the shopper will keep the funds, and the chargeback amount will not be credited to you.

Splitit does not assume responsibility for collecting amounts owed to you in cases where you win a chargeback but Splitit is unable to capture the outstanding balance.

What to Do When You Receive a Chargeback Notice from Splitit

1. Review the Chargeback Notice

Understand the reason for the chargeback. Begin by either accepting the chargeback or disputing it. If you choose to dispute, proceed to Step 2.

2. Gather Your Evidence

Evidence can consist of transaction receipts or order confirmations, proof of delivery for physical goods, your merchant refund policy, other communication with your shopper, Splitit receipts (electronically signed print statements from your Merchant Portal), Splitit's Refund Policy, Splitit's Terms of Use, etc.

3. Manage the Chargeback Case in Your Splitit Merchant Portal

Clearly present your evidence and provide a detailed response to the shopper's concern. It is crucial to be aware of the time constraints associated with disputing a chargeback, as outlined in the "Due Date" field in your Merchant Portal.

Locate and Review Your Chargeback Transactions

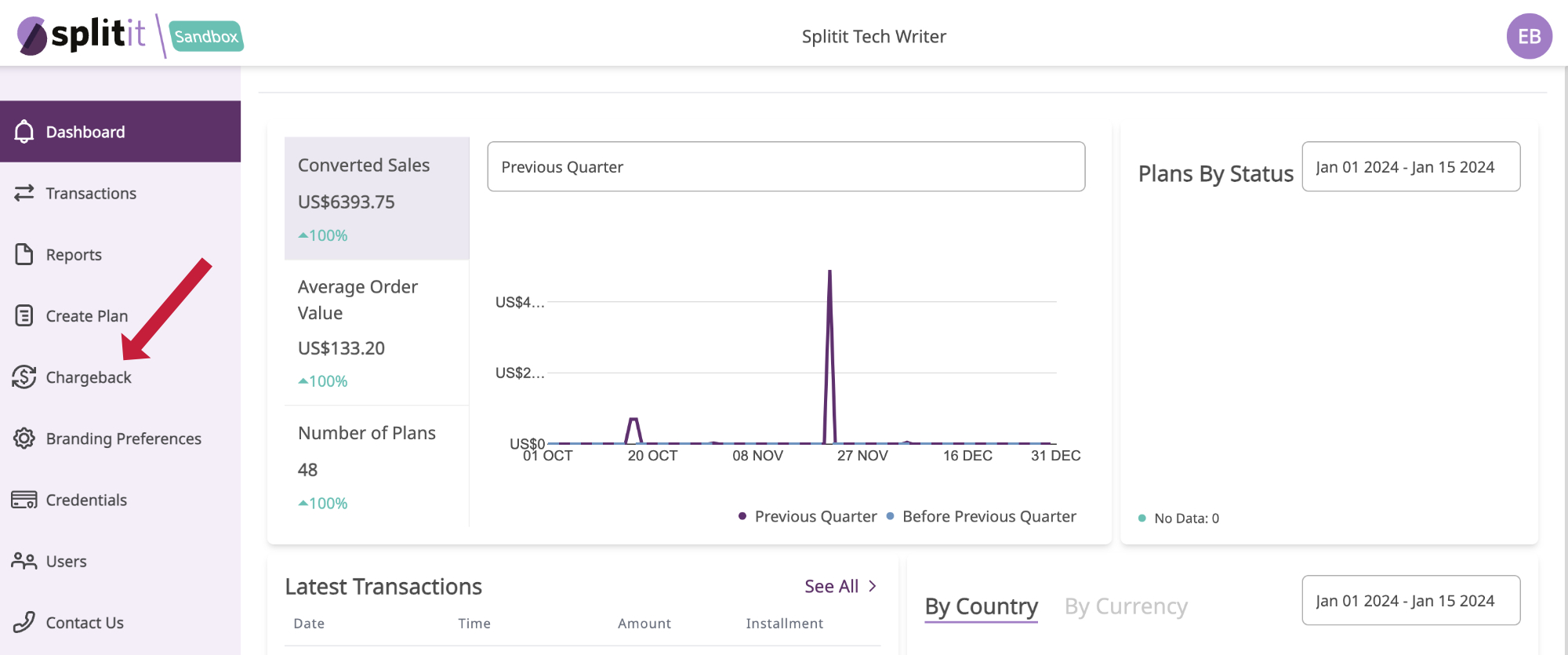

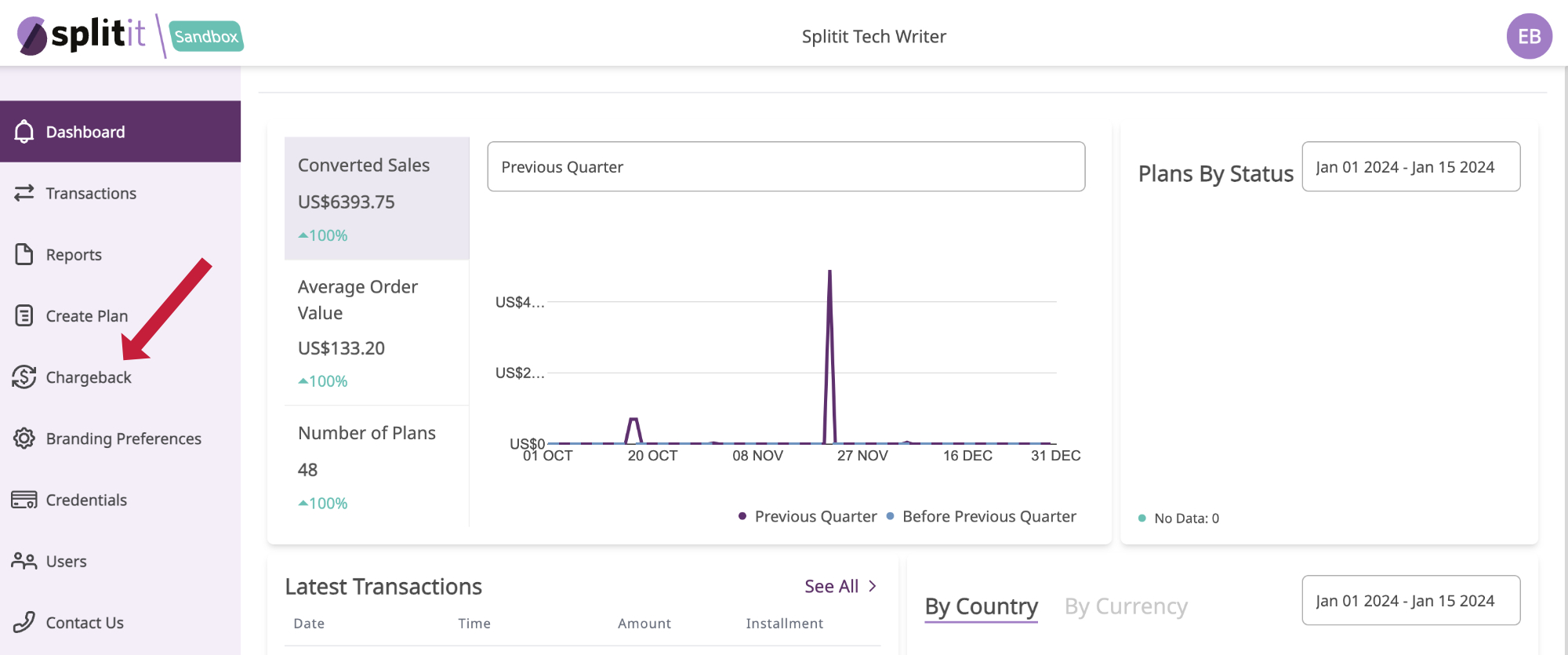

- Log into your Merchant Portal and click on Chargeback on the left-side menu.

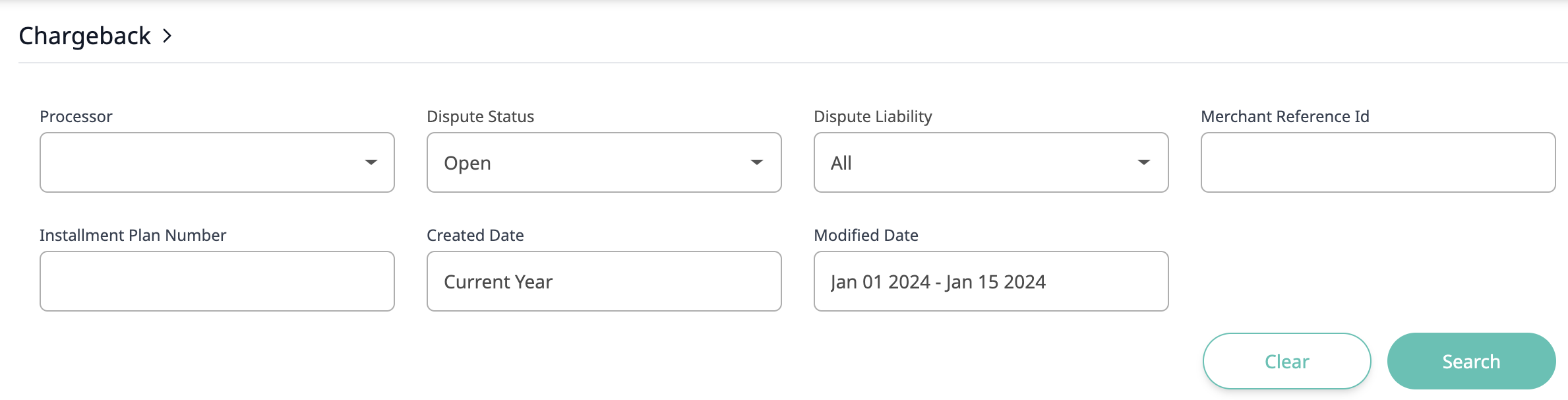

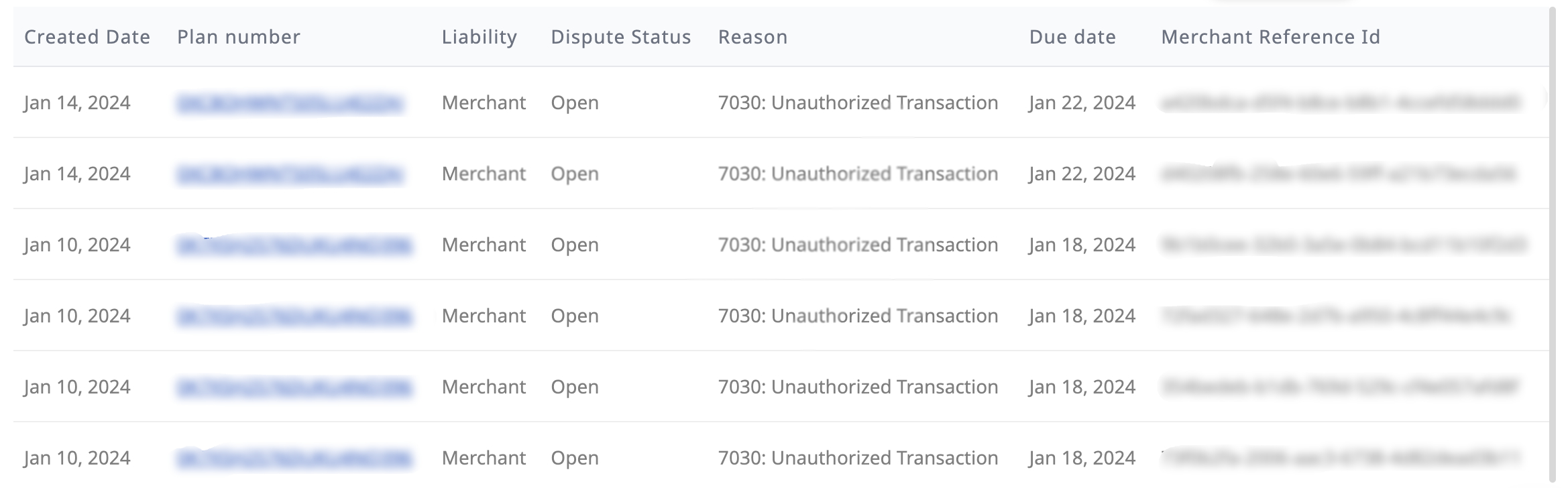

- Use the fields at the top to locate your chargeback, specifying a combination of Dispute Status, Dispute Liability, Reference Id, Installment Plan Number, Created Date and Modified Date. It is likely you can just leave the defaults if the chargeback is recent and you have very few chargebacks.

Click Search.

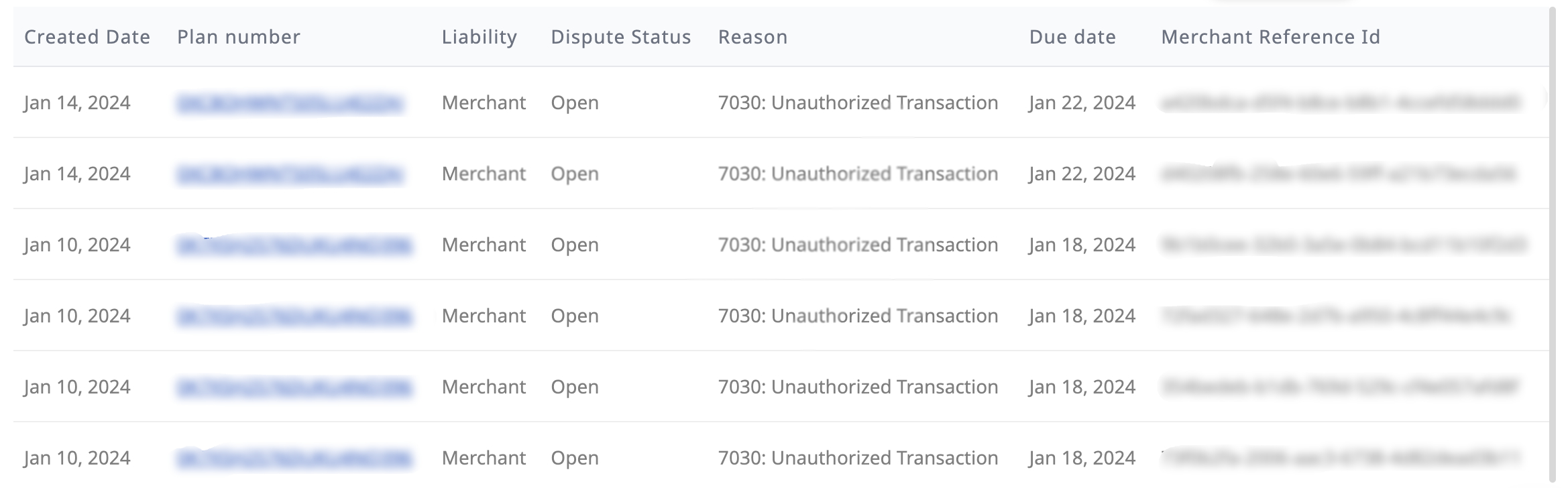

- In the list that appears under the search fields, each chargeback is given its own line (one plan may have multiple chargebacks). Note the Due Date here, which must be adhered to in order to dispute the chargeback. Click on the Plan Number of the chargeback(s) to go to the Transactions screen for that plan.

- On the Transactions screen, you can identify the transactions that were charged back by looking for the small hammer icons in the History pane:

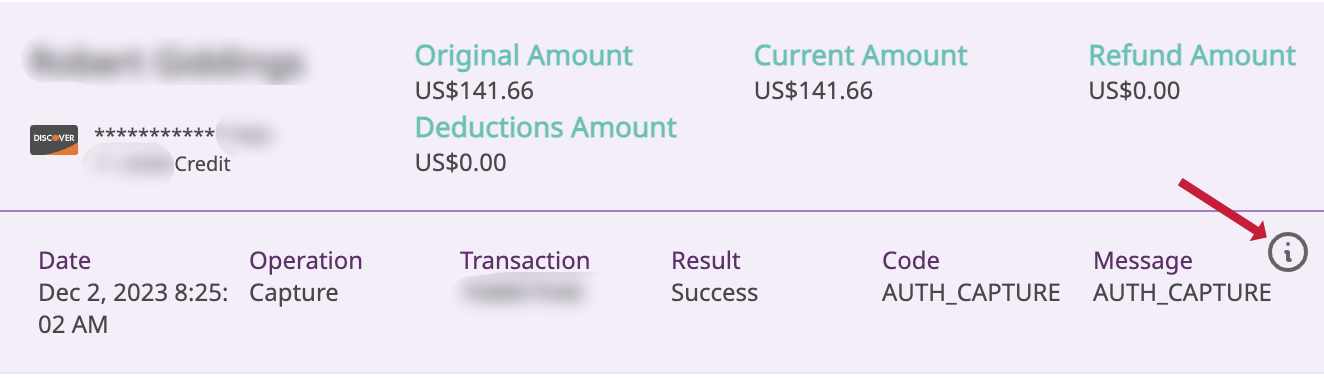

As with the non-chargeback transactions, you can click anywhere in a transaction line to open information about the transaction(s).

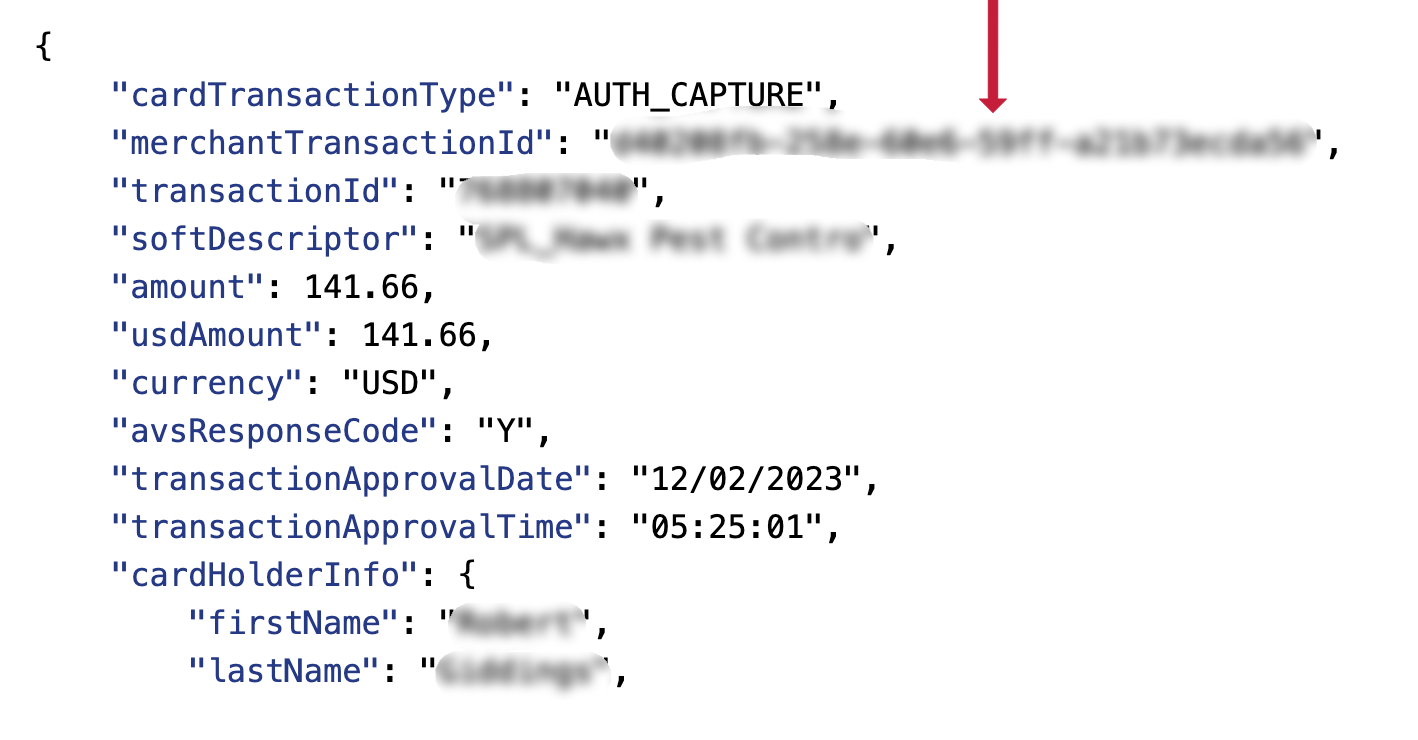

If you have multiple transactions, the easiest way to match the transactions here with the transactions on the previous screen (the chargebacks list), is to match Merchant Reference Id on the chargebacks list to merchantTransactionId here, which you can see by clicking the small “i” icon at lower right.

Dispute Your Chargebacks

- Return to your chargebacks list by hitting the back button in your browser or by going to Chargeback on the left-side menu and then searching again.

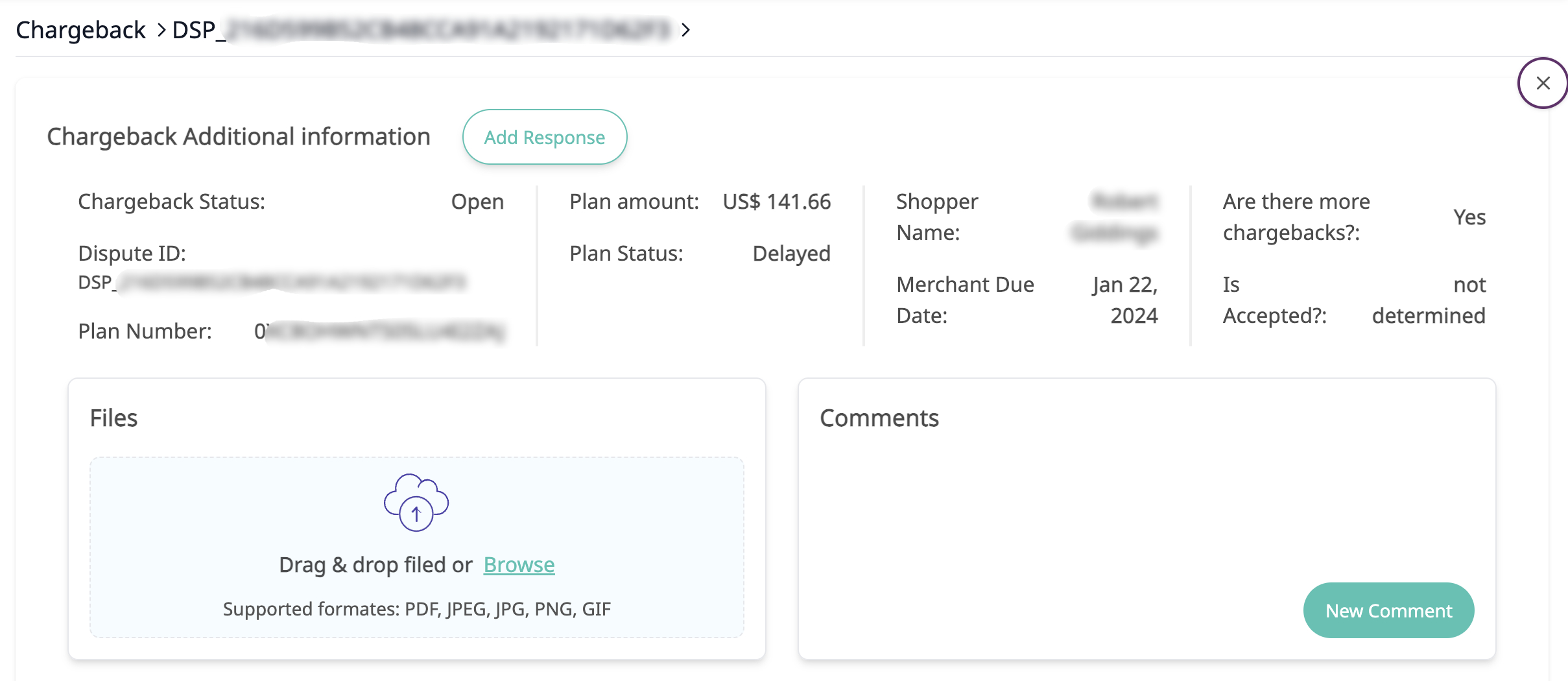

- In the chargebacks list at the bottom of the page, click anywhere in the row (except for the Plan Number) to open up the chargeback dialogue for that transaction.

- In the Files section, upload and submit your evidence by dragging and dropping, or by clicking Browse and uploading.

The most compelling evidence to fight a chargeback is "shopper communication," which contains various elements crucial for establishing a transaction's authenticity.

Examples are:

- Signed orders: You should obtain electronically signed print statements from the Splitit Merchant portal

- Delivery confirmation receipts

- Sales receipts/invoices

- Emails establishing a connection between the recipient of the products and the cardholder: Emphasize excerpts from the conversation where the shopper admits to having the product, focusing on key points rather than the entire discussion

- Validation of Splitit's Terms of Use

- Your Merchant Refund Policy

When submitting evidence:

- Circle key components in any supporting documents, such as delivery confirmations or signatures

- Include a copy of your one-page Terms of Service and Refund Policy, with relevant sections clearly circled

From the Files section, you can also delete files you have uploaded, or you can download one or all of them later.

- In the Comments section, click on New Comment and describe the case and the communication you had with the shopper. Provide a detailed description of your uploaded images, explaining how each supports your response in the internal notes section.

Finally click Add Response to finish your filing.

- Splitit will review your case as soon as possible. In the interim, you can return to this same chargeback dialogue to see any updates on your case (they will appear in the Comments section). You can also remove or add new files if necessary, or download your files. When Splitit comments on your case, you will receive an email.

Outcomes

Chargeback Initiated

- When a chargeback is initiated by a shopper, the corresponding chargeback amount will be temporarily collected from your merchant account

- In addition, a reserve amount consisting of the outstanding balance and any past charges at risk of chargeback (past charges whose capture date is < 120 days), will be collected into a reserve

- Your Settlement Report will have line items labeled "Chargeback" with the corresponding chargeback amount and "Chargeback Reserve" with the corresponding reserve amount

Chargeback Lost with Additional Chargebacks "Pending Decision":

-

If a single chargeback is lost, the plan will be canceled upon receiving the outcome regardless of a win or loss outcome on outstanding chargebacks

-

The previously collected chargeback amount will not be returned for any "Lost" chargeback

-

The previously collected chargeback amount will be returned for any chargeback "Won"

-

The remaining installments, if applicable, will be canceled, and we will collect the refunded amount from your merchant account and the reserve for the outstanding balance will be returned to you

- Losing even one chargeback will result in the plan's cancellation

-

Any past charge taken into reserve will be released upon completion of 120 days after the capture date, or any additional chargeback initiated against the reserved amount (see "Chargeback Reserve" section below)

-

Settlement Report:

-You will see a line labeled "ChargebackReverse" with the corresponding amount for any single chargeback that was won

-You will see a line labeled "ChargebackRefund" (-) with the outstanding plan amount due to the chargeback loss

-You will see a line labeled ‘ChargebackReserve’ (+) with the outstanding plan amount returned to you following the collection of the outstanding balance initiated by the refund

Chargeback Lost with NO Additional Chargebacks "Pending Decision":

- If the chargeback is lost, the associated plan will be automatically canceled

- The previously collected chargeback amount will not be returned

- The remaining installments, if applicable, will be canceled, and we will collect the refunded amount from your merchant account and the reserve for the outstanding balance will be returned to you

- Any past charge taken into reserve will be released upon completion of 120 days after the capture date or any additional chargeback initiated against the reserved amount (see "Chargeback Reserve" section below)

- Settlement Report:

- You will see a line labeled "ChargebackRefund" (-) with the outstanding plan amount due to the chargeback loss

- You will see a line labeled "ChargebackReserve" (+) with the outstanding plan amount returned to you following the collection of the outstanding balance initiated by the refund

Chargeback Won with Additional Chargebacks "Pending Decision":

- The previously collected chargeback amount will be returned to you if a chargeback is won

- In addition, the system will wait for the results of all chargebacks "Pending Decision”

- If all additional chargebacks are "Won", we will return the previously collected chargeback amounts and attempt to capture the plan's outstanding amount

- Settlement Report:

- You will see a line labeled "ChargebackReverse" with the corresponding amount for any single chargeback that was won

- You will see a line labeled "ChargebackReserve" (+) with the outstanding plan amount returned to you following the successful collection of the outstanding balance initiated by the capture

Chargeback Won with NO Additional Chargebacks "Pending Decision":

- The previously collected chargeback amount will be returned to you if the chargeback is won

- In addition, we will attempt to capture the outstanding amount of the plan

- Settlement Report:

- You will see a line labeled "ChargebackReverse" with the corresponding amount for any single chargeback that was won

- You will see a line labeled "ChargebackReserve" (+) with the outstanding plan amount returned to you following the successful collection of the outstanding balance initiated by the capture

Other Processes

Cancel Initiated Due to "Lost" Chargeback:

- If a plan is canceled, either due to a lost chargeback or a failed attempt to capture the outstanding amount after winning a chargeback, any outstanding amounts will be collected from your merchant account. You will see a line labeled "ChargebackRefund" in your Settlement Report with the outstanding plan amount

Chargeback Reserve: Holding and Releasing Funds

- If a chargeback was initiated on a plan, Splitit will reserve any past charges and the outstanding balance of that plan until the resolution of all chargebacks and the plan is completed

- Collecting Funds into Reserve

- When a chargeback is initiated on a plan, the past charges "at risk" and the outstanding balance will be held in a reserve

- Holding Period

- For past charges held in reserve, the reserve amount is held for 120 days from the capture date

- Example: For a transaction captured on January 1st and the reserve collected on March 15th, the past charges will be held until May 1st (120 days)

- For the outstanding balance held in reserve, the reserve amount is held until all open chargebacks are resolved and the plan is either canceled or captured for the outstanding amount

- Releasing Reserve Funds

- A Reserve can be released if:

- The 120-day holding period concludes

- Example: On May 1st, the funds reserved from the January 1st capture will be released

- A chargeback is initiated on another installment charge

- Example: On May 1st, the 1st installment charge of a Splitit plan was taken into reserve. On May 20th, a chargeback was initiated on that 1st installment. We will collect (-) the corresponding chargeback amount and simultaneously release the reserve back to you (+)

- The 120-day holding period concludes

- A Reserve can be released if:

- Chargebacks

- If a chargeback occurs within the 120-day holding period, the following actions will be taken:

- The chargeback amount is collected from the merchant

- The reserved funds for the specific transaction are released back to the merchant

- If a chargeback occurs within the 120-day holding period, the following actions will be taken:

Chargeback Fees

Chargeback fees vary by merchant agreement.

Definitions

Chargeback Statuses

Open: Chargeback case has been opened for review

Pending: A dispute has been submitted and is awaiting a result

Closed: Chargeback case closed by the shopper or issuer

Lost: Chargeback case ruled in favor of the shopper

Won: Chargeback case ruled in the merchant's favor

Other: Other reasons such as unrecognized

Codes

Visa

| Code | Description |

|---|---|

| 10.3 | Fraudulent Transaction: No Cardholder Authorization |

| 10.4 | Fraudulent Transaction: No Cardholder Authorization |

| 11.3 | Requested/Required Authorization Not Obtained |

| 12.4 | Processing Error |

| 12.5 | Incorrect Amount/Processing Error |

| 13.1 | Merchandise/Services Not Received |

| 13.2 | Cancelled Recurring |

| 13.3 | Not As Described or Defective Merchandise/Services |

| 13.5 | Misrepresentation |

| 13.6 | Credit Not Processed |

| 13.7 | Cancelled Merchandise/Services |

| 1.7.7.3 | Transaction Reversal or Adjustment |

Mastercard

| Code | Description |

|---|---|

| 4808 | Requested/Required Authorization Not Obtained |

| 4812 | Account Number Was Not on File |

| 4831 | Transaction Amount Differs |

| 4837 | Fraudulent Transaction: No Cardholder Authorization |

| 4841 | Cancelled Recurring Transaction |

| 4853 | Cardholder Dispute Defective/Not as Described |

| 4855 | Nonreceipt of Merchandise/Goods or Services Not Delivered |

FAQs

How long does the chargeback process take?

The chargeback process timeline varies depending on several factors, including the reason for the chargeback, the card network involved, and the efficiency of the parties involved in the resolution process. Typically, it can take up to 120 days.

How can I prevent chargebacks in the future?

Preventing chargebacks involves a combination of proactive measures, effective communication, and adherence to best practices including:

- Clear product descriptions

- Transparent billing descriptors

- Secure payment processing

- Excellent customer service

- Clear refund policy

Glossary

At-Risk Funds: At-risk funds are amounts whose capture date is less than 120 days ago, making them vulnerable to chargebacks

Capture Date: The date when a transaction is processed

Chargeback: A reversal of a transaction, initiated by the cardholder’s bank, usually due to a dispute over the transaction

Chargebacks "Pending Decision": This indicates that the review process for the initiated chargeback is ongoing. The issuing bank, acquiring bank, and possibly the merchant are examining the details of the dispute to determine its validity and decide whether the chargeback will be upheld or rejected

Chargeback Reverse: A term used to describe the process in which a previously disputed transaction, initially refunded to the customer through a chargeback, is resolved in favor of the merchant. Consequently, the funds are returned to the merchant's account

Holding Period: The "Holding Period" refers to the duration during which a reserve amount, equivalent to the captured transaction value, is held to mitigate the risk of a chargeback. During this time, the funds are not accessible to the merchant. This period typically lasts 120 days, ensuring that any potential chargeback claims can be processed and resolved before the reserved funds are released to the merchant

Reserve: A portion of funds held back from the merchant to cover potential chargebacks or disputes